Navigating the world of insurance claims can be a daunting experience, especially when dealing with a major event like a car accident or home damage. Progressive Insurance, known for its innovative approach and customer-centric services, aims to simplify the claims process. This comprehensive guide will equip you with the knowledge and resources to confidently handle your Progressive insurance claim, from finding the right phone number to understanding the various stages of resolution.

Whether you’re facing a car accident, a home burglary, or a medical emergency, understanding the steps involved in filing a claim with Progressive can make a significant difference in your experience. This guide will cover everything from identifying the appropriate contact information to navigating the claim filing process, ensuring you have the tools to navigate the process with ease and clarity.

Progressive Insurance Claims Process Overview

Progressive Insurance, a leading provider of auto insurance in the United States, offers a comprehensive claims process designed to ensure policyholders receive prompt and fair compensation for covered losses. The claims process is generally straightforward and can be completed entirely online or over the phone.

Filing a Claim

Filing a claim with Progressive is a simple process. Policyholders can report a claim online, through the Progressive mobile app, or by calling the Progressive claims hotline. The initial claim report requires basic information about the incident, such as the date, time, and location of the accident, as well as the names and contact information of all parties involved.

Types of Claims

Progressive handles a wide range of claims, including:

- Auto Accidents: These are the most common type of claim Progressive receives. Policyholders can file a claim for damage to their vehicle, injuries sustained in the accident, or both.

- Property Damage: Progressive also covers damage to property caused by insured events, such as fire, theft, vandalism, and natural disasters.

- Personal Injury: Policyholders can file a claim for injuries they sustain in an accident or other insured event.

- Uninsured/Underinsured Motorist Coverage: This coverage protects policyholders from drivers who are uninsured or underinsured.

- Medical Payments Coverage: This coverage pays for medical expenses incurred by the policyholder or passengers in their vehicle, regardless of fault.

Claim Process for Auto Accidents

The claims process for auto accidents typically involves the following steps:

- Report the Accident: The first step is to report the accident to Progressive as soon as possible. This can be done online, through the mobile app, or by calling the claims hotline.

- Provide Information: Policyholders will be asked to provide details about the accident, including the date, time, location, and any injuries sustained.

- Investigate the Claim: Progressive will investigate the claim to determine liability and the extent of damages.

- Receive a Settlement Offer: Once the investigation is complete, Progressive will make a settlement offer to the policyholder.

- Accept or Negotiate the Offer: The policyholder can accept the settlement offer or negotiate a higher amount.

Claim Process for Property Damage

The claims process for property damage is similar to the process for auto accidents. The policyholder will need to report the damage to Progressive and provide details about the incident. Progressive will then investigate the claim and make a settlement offer.

Claim Process for Personal Injury

The claims process for personal injury claims is more complex. Policyholders will need to provide medical documentation to support their claim. Progressive may also require a medical examination by an independent physician. Once the claim is investigated, Progressive will make a settlement offer.

Claim Process for Uninsured/Underinsured Motorist Coverage

If a policyholder is involved in an accident with an uninsured or underinsured driver, they can file a claim under their uninsured/underinsured motorist coverage. The claims process for this type of claim is similar to the process for auto accidents.

Claim Process for Medical Payments Coverage

Policyholders can file a claim for medical payments coverage if they incur medical expenses as a result of an accident or other insured event. The claims process for this type of claim is relatively simple and typically involves providing medical bills to Progressive.

Finding the Right Phone Number

Progressive offers various phone numbers for different types of claims. Identifying the correct number is crucial for a smooth and efficient claims process. This section will guide you on how to find the appropriate phone number for your specific situation.

Locating the Right Phone Number

Knowing which phone number to call is essential for initiating your claim. Here’s how to find the right one:

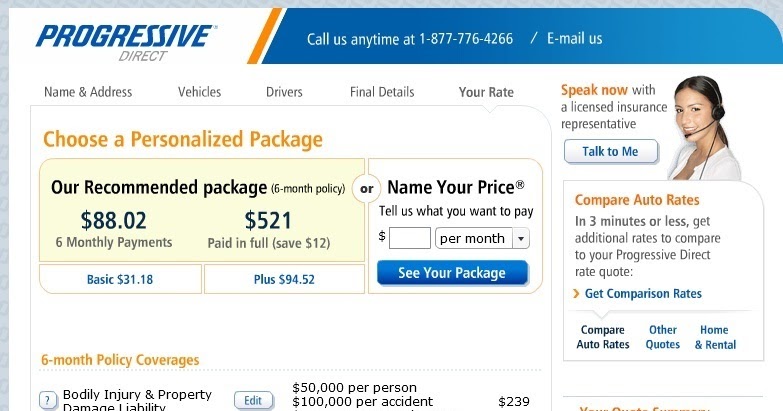

- Auto Claims: For auto accidents, use the main Progressive claims phone number, which is 1-800-PROGRESSIVE (1-800-776-4737). This number is available 24/7, ensuring you can reach Progressive at any time.

- Home and Renters Claims: For home or renters insurance claims, you’ll find the appropriate phone number on your policy documents. This number is typically listed under the “Claims” section of your policy.

- Other Claims: For other types of claims, such as boat or motorcycle insurance, refer to your policy documents for the designated phone number.

Finding the Phone Number on the Website or Mobile App

Progressive makes it easy to locate the appropriate phone number through their website or mobile app.

- Website: Navigate to the Progressive website and look for the “Claims” or “Contact Us” section. You’ll typically find a dedicated “Report a Claim” page with contact information for different claim types.

- Mobile App: Open the Progressive mobile app and look for the “Claims” or “Report Claim” section. You’ll find the necessary contact information within the app itself.

Contacting Progressive Claims Department

Reaching out to Progressive’s claims department is often necessary after an accident or incident. Understanding the best time to call and the information required can streamline the claims process.

Optimal Times to Contact Progressive

Calling during non-peak hours can significantly reduce wait times. Typically, mornings and late afternoons are less busy, while lunch breaks and the end of the workday are busier. For example, calling between 9:00 AM and 11:00 AM or 3:00 PM and 5:00 PM might be less crowded than calling during lunchtime.

Initiating a Claim Call

When initiating a claim call, be prepared to provide the following information:

- Your policy number

- Your driver’s license number

- Details of the accident, including date, time, location, and parties involved

- Any injuries sustained

- The damage to your vehicle

- The contact information of any other parties involved

Typical Waiting Times and Call Volume

Progressive’s claims department receives a high volume of calls, especially during peak hours. Depending on the time of day and day of the week, wait times can range from a few minutes to over an hour. During busy periods, consider using the Progressive mobile app or website to report your claim, which may be faster than calling.

It’s important to note that these are just general estimates, and actual wait times may vary.

Claim Filing Process

Filing a claim with Progressive Insurance can be a straightforward process, especially when you understand the steps involved and the necessary documentation. By understanding the process and effectively communicating with the claims representative, you can ensure a smooth and efficient resolution to your claim.

Reporting an Accident or Incident

Progressive Insurance offers multiple ways to report an accident or incident. These include:

- Online: Visit the Progressive website and navigate to the claims section. You will be guided through a series of prompts to provide details about the accident.

- Mobile App: The Progressive mobile app allows you to file a claim directly from your smartphone. You can capture photos and videos of the damage, and the app will guide you through the necessary steps.

- Phone: Calling Progressive’s claims department is the most direct way to report an accident. You will be connected with a claims representative who will gather the necessary information and initiate the claim process.

Required Documentation

When filing a claim with Progressive, you will typically need to provide the following documentation:

- Policy Information: Your policy number, coverage details, and contact information.

- Accident Details: Date, time, location, and description of the accident.

- Vehicle Information: Make, model, year, VIN, and license plate number of all vehicles involved.

- Driver Information: Name, address, driver’s license number, and insurance information of all drivers involved.

- Witness Information: Contact information of any witnesses to the accident.

- Photos and Videos: Clear images and videos of the damage to your vehicle and the accident scene.

- Police Report: If the accident involved a police report, a copy of the report should be provided.

- Medical Records: If you sustained injuries in the accident, you will need to provide medical records to support your claim.

Communicating with a Claims Representative

Effective communication is crucial when dealing with a claims representative. Here are some tips to ensure a smooth and efficient process:

- Be Clear and Concise: When describing the accident, use clear and concise language to avoid misunderstandings.

- Be Honest and Accurate: Provide accurate information about the accident and your vehicle.

- Be Patient and Cooperative: The claims process may take some time, so be patient and cooperative with the representative.

- Keep Records: Maintain copies of all documents and communications related to your claim.

- Ask Questions: If you have any questions or concerns, do not hesitate to ask the claims representative for clarification.

Claim Status Updates

After filing a claim with Progressive, it’s natural to want to know its status. Progressive provides several ways to check the progress of your claim, allowing you to stay informed throughout the process.

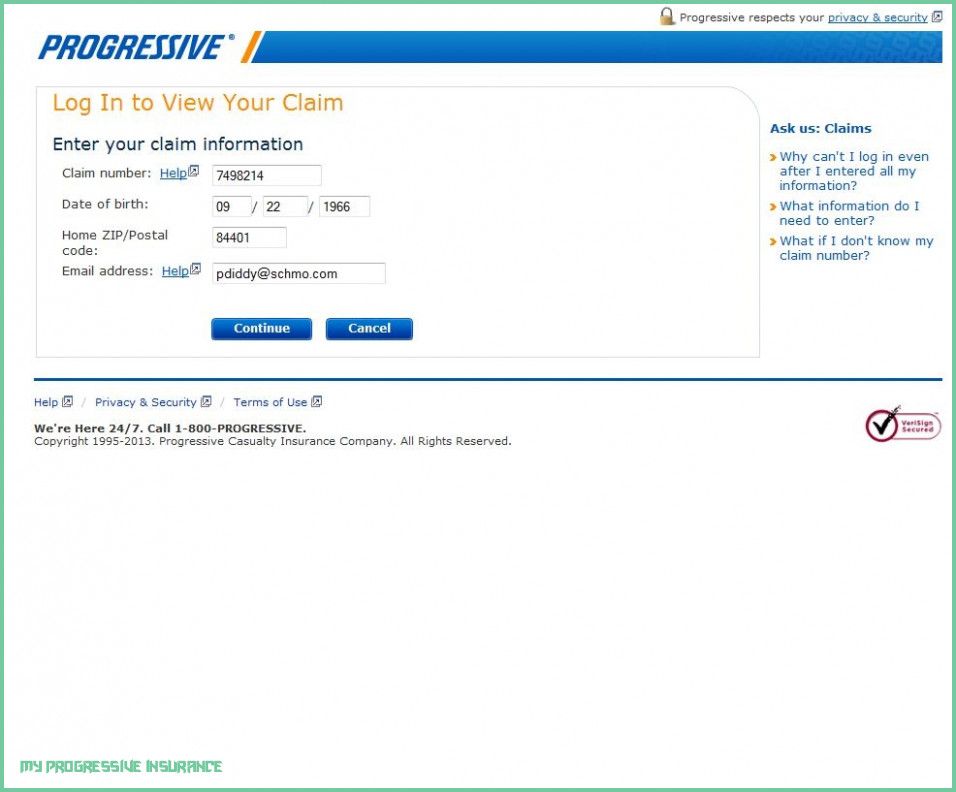

Online Claim Portal

Progressive offers a secure online portal where you can access your claim information. This portal provides a comprehensive view of your claim’s status, including any updates, documents, and communication from the claims representative.

- You can access the portal by visiting the Progressive website and logging into your account.

- Once logged in, navigate to the “Claims” section to view your claim details.

- The portal allows you to track the progress of your claim, upload supporting documents, and communicate with your claims representative.

Mobile App Features

Progressive’s mobile app provides convenient access to claim status updates on the go.

- The app offers similar features to the online portal, allowing you to check your claim’s status, review documents, and communicate with the claims representative.

- The app also sends notifications to your phone whenever there are updates on your claim, ensuring you stay informed.

Requesting Updates from the Claims Representative

If you prefer to speak with your claims representative directly, you can request updates by phone or email.

- The claims representative can provide personalized information about your claim’s progress and answer any questions you may have.

- They can also guide you through the next steps in the process and provide any necessary instructions.

Claim Resolution and Payment

Progressive Insurance strives to resolve claims efficiently and fairly, aiming to provide a seamless experience for its policyholders. The resolution process typically involves a thorough investigation, assessment of damages, and ultimately, the determination of coverage and payment.

Claim Resolution Timeline

The timeline for claim resolution can vary depending on the complexity of the claim and the availability of necessary information. A straightforward claim, such as a minor fender bender with clear evidence and minimal damage, might be resolved within a few weeks. However, more complex claims, involving significant damage, multiple parties, or disputed liability, could take several months to complete.

Payment Options

Progressive offers a variety of payment options to suit the needs of its policyholders. The most common payment methods include:

- Direct Deposit: This option allows policyholders to receive their claim payments directly into their bank accounts, offering convenience and speed.

- Check by Mail: Progressive can issue a check to the policyholder’s mailing address, a traditional method that provides flexibility.

- Electronic Payment: Policyholders can opt to receive their claim payment through an electronic transfer, allowing for quick access to funds.

Appealing a Claim Decision

If a policyholder disagrees with the outcome of a claim decision, they have the right to appeal the decision. The appeals process involves submitting a formal request to Progressive, outlining the reasons for the appeal and providing supporting documentation. Progressive will review the appeal and issue a final decision.

It is important to note that appealing a claim decision should be based on legitimate grounds, such as a miscalculation of damages or an incorrect interpretation of policy coverage.

Customer Service and Support

Progressive Insurance provides comprehensive customer service channels to assist policyholders with their insurance needs. The company offers a variety of options for contacting customer support, including phone, email, and social media.

24/7 Customer Support Availability

Progressive’s commitment to customer satisfaction is evident in its 24/7 customer support availability. This means that policyholders can reach a customer service representative at any time, day or night, regardless of the nature of their inquiry. Whether it’s a claim-related issue, policy modification, or simply a question about coverage, Progressive’s dedicated team is always ready to assist.

Claim Tips and Best Practices

Navigating the insurance claims process can be complex, but by following some key tips, you can increase your chances of a smooth and successful resolution. This section Artikels best practices for documenting your claim, communicating with Progressive representatives, and maximizing your claim’s outcome.

Accurate and Complete Documentation

Comprehensive and accurate documentation is crucial for supporting your claim and ensuring a fair settlement. This includes gathering all relevant information, such as police reports, medical records, repair estimates, and photographs.

- Police Reports: If your claim involves an accident, obtain a copy of the police report from the relevant authorities. This document provides a neutral account of the incident and is valuable evidence for your claim.

- Medical Records: For injury claims, gather all medical records, including doctor’s notes, treatment summaries, and prescriptions. This documentation establishes the extent of your injuries and the associated medical expenses.

- Repair Estimates: If your claim involves property damage, obtain multiple repair estimates from reputable repair shops. This ensures you are receiving a fair and competitive price for the repairs.

- Photographs: Take clear photographs of the damage to your vehicle, property, or injuries. These visual records provide compelling evidence for your claim.

Effective Communication with Progressive Representatives

Open and clear communication is vital throughout the claims process. Be prompt in responding to Progressive’s requests for information, and clearly articulate your concerns and expectations.

- Be Prompt and Responsive: Respond to Progressive’s inquiries promptly and provide all requested documentation. This demonstrates your commitment to resolving the claim efficiently.

- Be Clear and Concise: Clearly explain the details of your claim, including the date, time, location, and circumstances of the incident. Use precise language and avoid jargon.

- Document All Interactions: Keep a record of all communication with Progressive representatives, including dates, times, and the content of conversations. This ensures you have a clear understanding of the claim process and can reference any discrepancies.

- Maintain Professionalism: Communicate respectfully and professionally with Progressive representatives. Avoid emotional outbursts or confrontational language.

Maximizing Claim Success

By following these tips, you can increase your chances of a successful claim resolution:

- Understand Your Policy Coverage: Familiarize yourself with the terms and conditions of your insurance policy. This includes understanding your coverage limits, deductibles, and any exclusions.

- Follow Progressive’s Guidelines: Adhere to Progressive’s claim filing procedures and deadlines. This ensures your claim is processed smoothly and efficiently.

- Seek Professional Advice: If you have complex or challenging claims, consider seeking legal or financial advice from qualified professionals. They can provide guidance and support throughout the process.

Common Claim Issues and Solutions

Navigating the claims process can be challenging, and unexpected issues may arise. Delays, denials, or disputes can cause frustration and complicate the process of receiving compensation for your loss. Understanding common claim issues and their potential solutions can help you navigate these situations effectively.

Claim Delays

Delays in the claims process can occur due to various factors.

- Missing or Incomplete Documentation: Delays often arise when crucial information is missing or incomplete. Ensure you provide all necessary documentation, such as police reports, repair estimates, and medical records, to support your claim.

- Verification and Investigation: Progressive may need to verify information and conduct investigations to ensure the validity of your claim. This process can take time, especially for complex claims involving multiple parties or significant damages.

- Communication Gaps: Miscommunication or delays in communication between you and Progressive can also lead to delays. Stay in contact with your claims adjuster and proactively follow up on the status of your claim.

Claim Denials

Claim denials can be disheartening, but understanding the reasons behind them is crucial for seeking resolution.

- Policy Exclusions: Your insurance policy may contain specific exclusions that limit coverage for certain events or circumstances. For example, your policy might not cover damages caused by wear and tear or acts of God.

- Failure to Meet Policy Requirements: Denials can also occur if you fail to meet the requirements Artikeld in your policy, such as timely notification of the claim or providing accurate information.

- Pre-existing Conditions: If your claim involves pre-existing conditions, Progressive may deny coverage if they are not explicitly covered by your policy.

Claim Disputes

Disputes can arise when you and Progressive disagree on the value of your claim, the extent of coverage, or the amount of compensation.

- Valuation Discrepancies: Disagreements can occur when you and Progressive have different valuations for your damaged property or the cost of repairs. It’s important to have supporting documentation, such as repair estimates from reputable vendors, to justify your position.

- Coverage Interpretation: Disputes may arise when there are differing interpretations of the terms and conditions of your insurance policy. Carefully review your policy and seek clarification from Progressive if you have any questions.

- Negotiation and Mediation: In cases of disputes, negotiation and mediation can help reach a mutually agreeable resolution. If you are unable to reach an agreement, you may consider seeking legal advice.

Progressive’s Claim Handling Reputation

Progressive Insurance has built a reputation for its claims handling process, but opinions vary. While some customers praise its efficiency and customer service, others express dissatisfaction with the process. To understand Progressive’s claims handling reputation, we’ll delve into its track record, compare it to other providers, and examine customer feedback.

Progressive’s Claims Handling Track Record

Progressive has a mixed track record in handling claims. Some studies and reports highlight its strengths, while others point to areas for improvement. For instance, J.D. Power’s 2023 U.S. Auto Claims Satisfaction Study ranked Progressive above average in overall customer satisfaction with its claims process. The study highlighted the insurer’s positive attributes, including:

- Efficient claim processing times.

- Helpful and responsive customer service representatives.

- Transparent communication throughout the claims process.

However, other reports and customer reviews reveal areas where Progressive could improve:

- Some customers have reported lengthy claim processing times, particularly for complex or disputed claims.

- Others have criticized the insurer’s communication, citing delays in receiving updates or lack of clarity regarding claim status.

- There have also been concerns about the insurer’s claim settlement practices, with some customers alleging unfair or low settlements.

Comparison with Other Insurance Providers

Progressive’s claims handling process compares favorably to some insurance providers, particularly in terms of its digital tools and online claim filing options. However, other insurers, such as Geico and USAA, consistently rank higher in customer satisfaction surveys regarding claims handling.

Customer Reviews and Feedback

Customer reviews and feedback provide valuable insights into Progressive’s claims handling reputation. While some customers praise the insurer’s ease of use and prompt service, others express frustration with long wait times, bureaucratic hurdles, and difficulties in resolving disputes.

“I was very impressed with Progressive’s claims process. My claim was processed quickly and efficiently, and the customer service representatives were very helpful.” – [Customer Review on Trustpilot]

“I had a terrible experience with Progressive’s claims department. My claim took weeks to be processed, and I had to call multiple times to get updates. The customer service representatives were unhelpful and rude.” – [Customer Review on Yelp]

These contrasting experiences highlight the need for a nuanced understanding of Progressive’s claims handling reputation. While the insurer excels in some areas, it faces challenges in others.

Ending Remarks

In conclusion, navigating a Progressive insurance claim doesn’t have to be an overwhelming experience. By understanding the process, knowing where to find the right contact information, and utilizing the resources available, you can streamline the process and ensure a smooth resolution. Remember, Progressive’s commitment to customer service extends beyond the initial policy purchase and encompasses every step of the claim journey.