Navigating the world of auto insurance in Georgia can feel like a maze, especially when seeking affordable coverage. With numerous factors influencing premiums, from your driving history to the type of vehicle you own, finding the best deal can seem daunting. But fear not! This comprehensive guide will equip you with the knowledge and strategies to secure cheap auto insurance in Georgia, ensuring you’re protected on the road without breaking the bank.

We’ll delve into the essential aspects of Georgia’s auto insurance requirements, including mandatory coverages and minimum liability limits. You’ll discover how key factors like driving history, age, and credit score impact your premiums, and learn how to leverage discounts and negotiate lower rates. We’ll also explore online comparison tools and provide insights on choosing the right insurance company for your specific needs. By the end of this guide, you’ll be empowered to confidently navigate the Georgia auto insurance landscape and find the most affordable coverage for your peace of mind.

Understanding Georgia’s Auto Insurance Requirements

Driving in Georgia comes with certain legal responsibilities, including carrying the right auto insurance. Understanding these requirements is crucial to ensure you’re legally protected and avoid potential penalties.

Minimum Liability Coverage Requirements

Georgia law mandates all drivers to have minimum liability insurance coverage. This coverage protects you financially if you’re at fault in an accident that causes injury or damage to others.

The minimum liability limits in Georgia are:

* Bodily Injury Liability: $25,000 per person, $50,000 per accident. This covers medical expenses, lost wages, and other damages for injuries caused to others.

* Property Damage Liability: $25,000 per accident. This covers damages to another person’s vehicle or property, such as a fence or building.

The Importance of Uninsured/Underinsured Motorist Coverage

While Georgia requires minimum liability coverage, it’s important to consider additional protection, especially in situations involving uninsured or underinsured drivers.

Uninsured/underinsured motorist (UM/UIM) coverage provides financial protection if you’re involved in an accident with a driver who has no insurance or insufficient coverage. This coverage can help cover your medical bills, lost wages, and other expenses.

It’s essential to understand that Georgia law allows you to reject UM/UIM coverage, but it’s highly recommended to keep this protection in place.

Factors Influencing Auto Insurance Costs in Georgia

Auto insurance premiums in Georgia are determined by a combination of factors, each contributing to the overall cost. Understanding these factors allows drivers to make informed decisions about their coverage and potentially save money.

Driving History

A driver’s past driving record significantly impacts their insurance premiums. Insurance companies assess driving history to determine the likelihood of future accidents. A clean record with no accidents or traffic violations usually results in lower premiums. Conversely, drivers with a history of accidents, speeding tickets, or DUI convictions are considered higher risk and often face higher premiums.

Age

Age is another key factor in determining auto insurance costs. Younger drivers, especially those under 25, are statistically more likely to be involved in accidents. This higher risk translates into higher premiums for young drivers. As drivers age and gain more experience, their premiums typically decrease.

Credit Score

Surprisingly, credit score can influence auto insurance rates in Georgia. Insurance companies use credit scores as a proxy for financial responsibility, believing that those with good credit are more likely to pay their premiums on time. While this practice is controversial, some insurance companies in Georgia consider credit scores when calculating premiums.

Vehicle Type

The type of vehicle you drive also plays a role in your insurance costs. High-performance cars, luxury vehicles, and expensive SUVs are generally more expensive to repair or replace, leading to higher insurance premiums. Conversely, older, less expensive cars typically have lower insurance rates.

Location

Where you live in Georgia can affect your insurance premiums. Areas with high crime rates, traffic congestion, or a high frequency of accidents often have higher insurance rates.

Coverage Levels

The level of coverage you choose also influences your premiums. Higher coverage limits, such as liability coverage or comprehensive and collision coverage, typically result in higher premiums.

Finding Affordable Auto Insurance Options in Georgia

Navigating the world of auto insurance in Georgia can be a daunting task, especially when you’re looking for the most affordable options. With a multitude of insurance companies offering diverse policies and discounts, finding the best fit for your needs and budget requires careful research and comparison.

Types of Auto Insurance Policies in Georgia

Georgia law mandates certain types of auto insurance coverage for all drivers. These mandatory coverages are designed to protect you and others in case of an accident. Understanding the different types of policies available helps you choose the right level of coverage that meets your specific needs and financial situation.

- Liability Coverage: This is the most basic type of insurance, covering damages to other vehicles and injuries to other people in an accident that you cause. Georgia requires a minimum of $25,000 per person/$50,000 per accident for bodily injury liability and $25,000 per accident for property damage liability.

- Personal Injury Protection (PIP): This coverage pays for your medical expenses, lost wages, and other related costs regardless of who is at fault in an accident. Georgia requires a minimum of $5,000 in PIP coverage.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who has no insurance or insufficient insurance to cover your damages. It’s crucial to have this coverage, as many drivers operate without adequate insurance.

- Collision Coverage: This coverage pays for repairs to your vehicle if you are involved in an accident, regardless of who is at fault.

- Comprehensive Coverage: This coverage protects your vehicle against damages caused by events other than collisions, such as theft, vandalism, fire, or natural disasters.

Discounts Offered by Insurance Companies in Georgia

Insurance companies in Georgia offer a variety of discounts to help policyholders save money on their premiums. These discounts can significantly reduce your overall insurance costs, making it crucial to inquire about all available options.

- Good Driver Discount: This discount is offered to drivers with a clean driving record, demonstrating responsible driving habits.

- Safe Driver Discount: Similar to the good driver discount, this discount rewards drivers who maintain a safe driving record, often achieved through defensive driving courses or other safety programs.

- Multi-Car Discount: Insurance companies often offer discounts for insuring multiple vehicles with the same provider.

- Multi-Policy Discount: If you bundle your auto insurance with other types of insurance, such as homeowners or renters insurance, you can qualify for a significant discount.

- Loyalty Discount: Some companies offer discounts to policyholders who have been loyal customers for a specific period.

- Student Discount: Good grades and participation in extracurricular activities can earn students a discount on their auto insurance premiums.

- Anti-theft Device Discount: Installing anti-theft devices in your vehicle, such as alarms or tracking systems, can qualify you for a discount.

- Telematics Discount: Some insurance companies offer discounts based on your driving habits, monitored through telematics devices that track your speed, braking, and other driving behaviors.

Tips for Negotiating Lower Premiums with Insurance Providers

While finding affordable auto insurance in Georgia requires careful research and comparison, negotiating with insurance providers can further reduce your premiums. By leveraging your knowledge and understanding of the market, you can potentially secure a more favorable deal.

- Shop Around: Get quotes from multiple insurance companies to compare prices and coverage options.

- Consider Increasing Your Deductible: Raising your deductible, the amount you pay out-of-pocket before your insurance kicks in, can lower your premium. However, ensure you can afford the increased deductible in case of an accident.

- Bundle Your Policies: As mentioned earlier, bundling your auto insurance with other types of insurance can lead to significant savings.

- Negotiate for Discounts: Be proactive in asking about available discounts and ensure you qualify for all applicable ones.

- Be Prepared to Switch Providers: If you’re not satisfied with your current provider, be prepared to switch to another company that offers more competitive rates.

Online Auto Insurance Quotes and Comparison Tools

The digital age has revolutionized how consumers shop for auto insurance. Online quote comparison tools provide a convenient and efficient way to compare rates from multiple insurers, empowering drivers to find the most affordable coverage.

Benefits of Online Quote Comparison Tools

Online quote comparison tools offer several advantages for Georgia drivers seeking affordable auto insurance:

- Convenience: Drivers can obtain quotes from multiple insurers within minutes from the comfort of their homes, eliminating the need for phone calls or in-person visits.

- Time-Saving: Comparison tools streamline the process of gathering quotes, saving valuable time that would otherwise be spent contacting individual insurers.

- Transparency: These tools present a clear and concise comparison of rates, coverage options, and policy details, allowing drivers to make informed decisions.

- Competition: The availability of multiple quotes fosters competition among insurers, potentially leading to lower premiums for consumers.

Reputable Online Insurance Comparison Websites

Several reputable online insurance comparison websites cater to Georgia drivers:

- Insurify: This platform allows users to compare quotes from over 20 insurers, including major carriers and regional providers.

- Policygenius: This website provides a comprehensive comparison of auto insurance quotes, along with personalized recommendations based on individual needs.

- The Zebra: This platform offers a user-friendly interface and detailed comparisons of rates, coverage options, and customer reviews.

- Compare.com: This website allows users to compare quotes from over 20 insurers, including major carriers and regional providers.

Comparison Platform Features and Functionalities

Online insurance comparison websites typically offer various features and functionalities:

| Feature | Description |

|---|---|

| Quote Comparison | Displays quotes from multiple insurers side-by-side, allowing for easy comparison of rates and coverage options. |

| Coverage Customization | Allows users to adjust coverage levels and deductibles to tailor policies to their specific needs. |

| Discount Eligibility | Identifies potential discounts based on factors such as good driving history, safety features, and multiple policy bundling. |

| Customer Reviews | Provides insights into customer satisfaction with different insurers based on user reviews and ratings. |

| Policy Management | Allows users to manage existing policies, make changes, or request cancellations. |

Understanding Insurance Policy Exclusions and Limitations

While auto insurance provides crucial financial protection, it’s essential to understand the policy’s limitations and exclusions. These provisions define situations where coverage may not apply, leaving you responsible for costs.

Common Exclusions and Limitations

Exclusions and limitations are designed to manage risk and prevent abuse. These common provisions are found in most auto insurance policies:

- Intentional Acts: Insurance typically doesn’t cover damage or injuries resulting from intentional acts, such as driving under the influence or reckless driving.

- Wear and Tear: Routine maintenance and wear and tear are not covered. For instance, a worn-out tire blowout is not covered.

- Certain Types of Vehicles: Coverage may be limited or excluded for certain types of vehicles, such as motorcycles, recreational vehicles (RVs), or commercial trucks.

- Uninsured Motorists Coverage: This coverage may have limitations on the amount of coverage available for injuries caused by an uninsured or hit-and-run driver.

- Rental Car Coverage: Coverage for rental cars may be limited to a specific duration or have restrictions on the types of rental cars allowed.

Deductibles and Co-pays

Deductibles and co-pays are crucial elements of insurance policies that determine your financial responsibility in claims.

- Deductible: This is the fixed amount you pay out-of-pocket for each covered claim before your insurance coverage kicks in. For example, if your deductible is $500, you pay $500 for repairs after an accident, and your insurance covers the rest.

- Co-pay: This is a fixed amount you pay for certain services, like medical care, even after your deductible is met. Co-pays help control healthcare costs and encourage responsible use of medical services.

Examples of Situations Where Coverage Might Be Denied

Understanding specific situations where coverage might be denied is crucial for avoiding financial surprises. Here are some examples:

- Driving without a valid license: Driving without a valid license is typically not covered by insurance, as it violates the law.

- Driving a vehicle not listed on your policy: If you’re driving a vehicle not listed on your policy, you may not have coverage in case of an accident.

- Driving while intoxicated: Driving under the influence of alcohol or drugs is a serious offense and may result in coverage denial.

- Using your vehicle for commercial purposes: If you use your vehicle for business purposes without the appropriate commercial insurance, your personal policy may not cover accidents.

Navigating the Claims Process in Georgia

Filing an auto insurance claim in Georgia can be a stressful experience, but understanding the process and following the right steps can help you navigate it smoothly. This section will guide you through the necessary steps to file a claim, the required documentation, and tips for maximizing your payout.

Steps Involved in Filing an Auto Insurance Claim

Filing an auto insurance claim in Georgia typically involves the following steps:

- Contact Your Insurance Company: The first step is to contact your insurance company as soon as possible after an accident. Inform them of the incident and provide details about the accident, including the date, time, location, and any injuries involved.

- File a Claim: Your insurance company will guide you through the claim filing process, which may involve completing a claim form or providing information online.

- Provide Necessary Documentation: You will need to provide your insurance company with certain documentation to support your claim, such as a police report, photos of the damage, and medical records if applicable.

- Cooperate with the Insurance Company: Be prepared to answer questions from your insurance company and cooperate with their investigation. This may involve providing additional information or attending an inspection of your vehicle.

- Negotiate a Settlement: Once the investigation is complete, your insurance company will present you with a settlement offer. If you disagree with the offer, you have the right to negotiate a higher amount.

Documentation Required for a Successful Claim

Having the right documentation is crucial for a successful auto insurance claim in Georgia. Here are some essential documents:

- Police Report: A police report is essential for documenting the accident and providing evidence of the incident. In Georgia, it’s mandatory to report any accident resulting in injuries or property damage exceeding $500.

- Photos of the Damage: Take clear photos of the damage to your vehicle and the accident scene. These photos will help support your claim and provide evidence of the extent of the damage.

- Medical Records: If you were injured in the accident, gather your medical records, including bills and treatment documentation. This documentation will be crucial for supporting your claim for medical expenses.

- Witness Statements: If anyone witnessed the accident, obtain their contact information and statements. Witness statements can provide valuable evidence to support your claim.

- Vehicle Registration and Insurance Information: Ensure you have your vehicle registration and insurance information readily available. This information will be needed to verify your coverage and identify the responsible parties.

Tips for Maximizing Your Claim Payout

While filing an auto insurance claim in Georgia, consider these tips to maximize your payout:

- Document Everything: Keep a detailed record of all communications, including dates, times, and details of conversations with your insurance company. This documentation can be helpful if any disputes arise.

- Seek Medical Attention: If you were injured in the accident, seek medical attention immediately. This will ensure proper treatment and provide documentation to support your claim.

- Get Multiple Quotes: If your insurance company offers you a settlement, consider getting quotes from other repair shops or body shops to ensure you’re receiving a fair price for repairs.

- Negotiate: Don’t be afraid to negotiate with your insurance company. If you believe the settlement offer is too low, explain your reasoning and request a higher amount.

- Consult with an Attorney: If you have difficulty negotiating with your insurance company or believe your claim is being unfairly denied, consider consulting with an attorney specializing in auto insurance claims.

Choosing the Right Insurance Company for Your Needs

Selecting the right auto insurance company is crucial, as it directly impacts your coverage, premiums, and overall experience. A thorough assessment of various factors is essential to ensure you choose a provider that aligns with your individual needs and budget.

Comparing Services and Customer Support

Understanding the services and customer support offered by different insurance providers is paramount. It’s essential to evaluate factors such as:

- Claims processing speed and efficiency: Research a company’s average claims processing time and customer satisfaction with their claims handling procedures.

- Availability of online and mobile tools: Evaluate the ease of managing your policy, making payments, and accessing customer support through online platforms and mobile apps.

- 24/7 customer service availability: Ensure the company provides reliable customer service support around the clock, particularly in case of emergencies.

Assessing Financial Stability and Claims History

A company’s financial stability and claims history are crucial indicators of its reliability.

- Financial ratings: Consult reputable financial rating agencies like AM Best or Standard & Poor’s to assess the company’s financial strength and ability to fulfill its obligations.

- Claims history: Investigate the company’s track record of paying claims promptly and fairly. Look for information on the company’s average claim settlement time and customer satisfaction with claim outcomes.

Reputable Auto Insurance Companies in Georgia

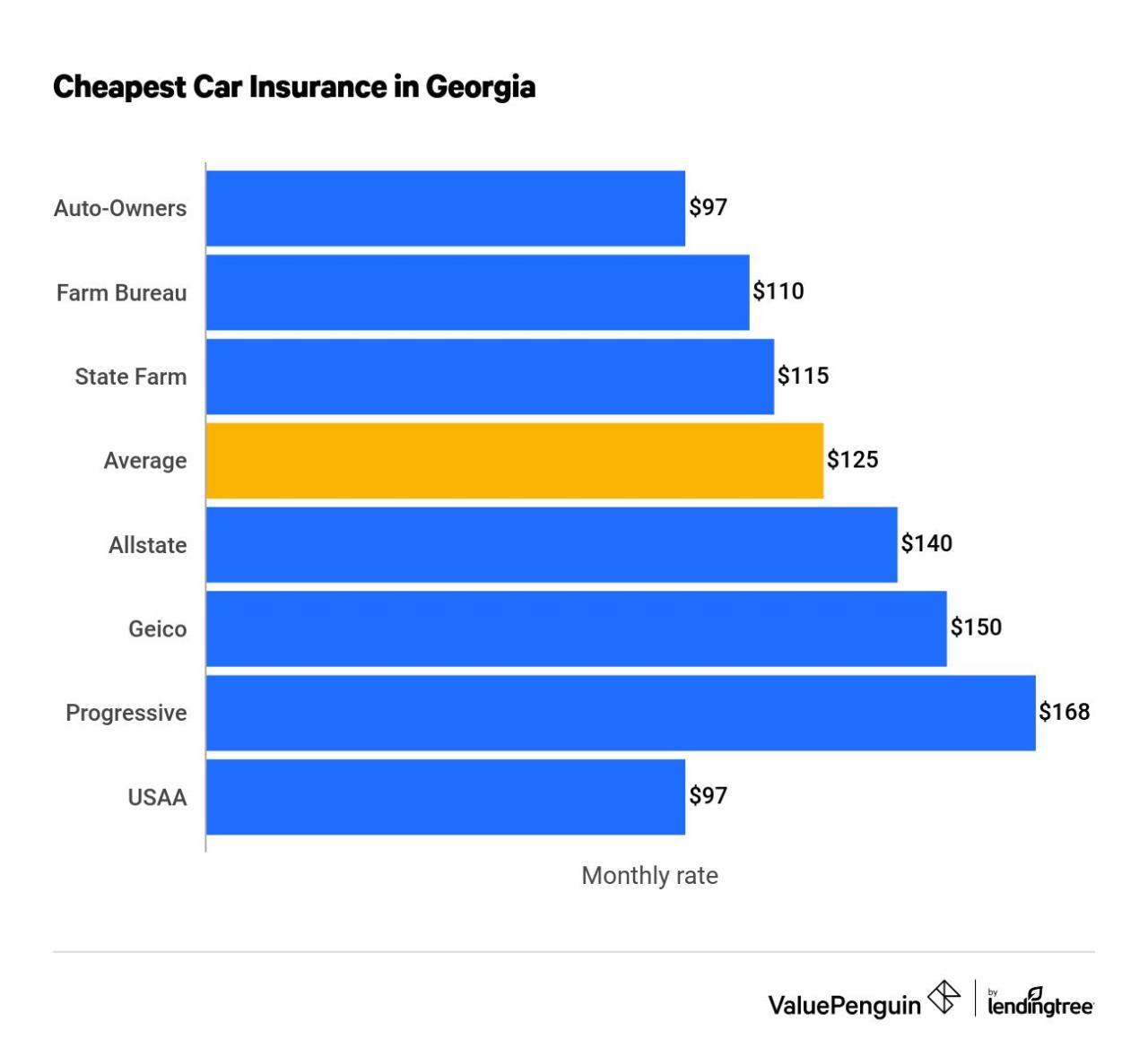

Several reputable auto insurance companies operate in Georgia, each offering unique features and benefits.

- State Farm: State Farm is a leading national insurer known for its extensive network of agents and comprehensive coverage options.

- GEICO: GEICO is another major insurer known for its competitive rates and convenient online and mobile tools.

- Progressive: Progressive is known for its innovative features, such as its Name Your Price tool that allows you to set your desired premium and find a policy that matches.

- Allstate: Allstate offers a wide range of coverage options and discounts, including its Drive Safe & Save program that rewards safe driving habits.

Exploring Alternative Insurance Options

Beyond traditional auto insurance policies, Georgia drivers have access to alternative options that can potentially lower their premiums and offer tailored coverage. These options include usage-based insurance and group insurance plans, providing flexibility and savings for various driver profiles.

Usage-Based Insurance

Usage-based insurance (UBI) programs utilize telematics devices or smartphone apps to track driving habits, such as mileage, time of day, and braking patterns. By demonstrating safe driving practices, policyholders can earn discounts and potentially lower their premiums.

- How it works: UBI programs typically involve installing a device in your vehicle or using a smartphone app that tracks your driving behavior. This data is then analyzed to assess your driving habits, such as speeding, hard braking, and driving at night.

- Potential benefits: Safe drivers who participate in UBI programs can often receive significant discounts on their premiums. These programs incentivize safe driving practices and reward responsible drivers.

- Examples: Several major insurance companies in Georgia offer UBI programs, including State Farm, Geico, and Progressive. The specific features and benefits of these programs may vary.

Group Insurance Plans

Group insurance plans are offered to members of specific organizations, such as professional associations, employee groups, or alumni associations. These plans often provide discounted rates due to the collective bargaining power of the group.

- Eligibility: To qualify for a group insurance plan, you typically need to be a member of the sponsoring organization. The specific eligibility criteria may vary depending on the plan.

- Advantages: Group insurance plans often offer lower premiums compared to individual policies. The group’s bargaining power allows for negotiated rates with insurance providers.

- Examples: In Georgia, several professional organizations, such as the Georgia Bar Association, offer group insurance plans to their members. Additionally, some employers provide group insurance plans as a benefit to their employees.

Insurance Options for Specific Needs

For drivers with unique circumstances, such as young drivers or those with limited driving history, specialized insurance options are available. These options can help address specific risks and provide appropriate coverage.

- Young Drivers: Insurance companies often offer programs tailored to young drivers, which may include discounts for good grades, driver’s education courses, or safe driving records.

- Limited Driving History: Drivers with limited driving history may be eligible for programs that provide coverage based on their driving experience and risk profile. These programs may involve higher premiums initially but can be adjusted as the driver gains more experience.

Understanding the Importance of Comprehensive Coverage

Comprehensive coverage, a crucial component of auto insurance, safeguards you against financial burdens arising from damages to your vehicle caused by events beyond your control, such as theft, vandalism, natural disasters, or collisions with animals. It offers peace of mind, knowing that your insurance policy will cover the repair or replacement costs for your vehicle, even if you’re not at fault.

Situations Where Comprehensive Coverage is Valuable

Comprehensive coverage proves invaluable in a multitude of scenarios. Here are a few examples:

- Theft: If your vehicle is stolen, comprehensive coverage will help you recover the cost of replacing it, minus your deductible. It can be a lifesaver, especially in areas with high theft rates.

- Vandalism: If your vehicle is vandalized, comprehensive coverage will cover the cost of repairs, including damage to the paint, windows, or interior. This protection can be crucial for protecting your investment in your vehicle.

- Natural Disasters: In the event of a natural disaster like a hurricane, flood, or earthquake, comprehensive coverage will cover the damage to your vehicle, even if you’re unable to prevent it. This can provide vital financial support in times of crisis.

- Collision with Animals: Accidents involving animals can cause significant damage to your vehicle. Comprehensive coverage will cover the cost of repairs, ensuring you’re not left with a hefty bill.

Costs and Benefits of Comprehensive Coverage

Adding comprehensive coverage to your auto insurance policy involves a trade-off between cost and protection. While it increases your monthly premium, it offers significant benefits, including:

- Financial Protection: Comprehensive coverage shields you from substantial out-of-pocket expenses for unexpected vehicle damage, providing peace of mind and financial stability.

- Peace of Mind: Knowing that your vehicle is protected against various perils can reduce stress and anxiety, allowing you to focus on other priorities.

- Enhanced Value: Comprehensive coverage can increase the value of your vehicle, making it more attractive to potential buyers in the future.

Auto Insurance for High-Risk Drivers

Navigating the world of auto insurance can be challenging, but for high-risk drivers, the process can feel even more daunting. High-risk drivers, typically those with a history of accidents, traffic violations, or other factors that increase the likelihood of claims, often face higher premiums and limited options. Understanding the specific challenges and available solutions is crucial for securing affordable and adequate coverage.

Specialized Insurance Programs for High-Risk Drivers

For drivers with a less-than-perfect driving record, traditional insurance companies may not offer competitive rates or may even decline coverage altogether. Fortunately, specialized insurance programs cater specifically to high-risk drivers, providing them with access to coverage that might otherwise be unavailable. These programs typically operate under different risk assessment models, considering factors beyond just driving history.

Tips for Securing Affordable Coverage

Securing affordable auto insurance with a challenging driving history requires proactive steps and a thorough understanding of your options. Here are some valuable tips to help you navigate the process:

- Shop Around: Comparing quotes from multiple insurers, including specialized programs for high-risk drivers, is essential to finding the most competitive rates. Online comparison tools can streamline this process.

- Improve Your Driving Record: Even a minor improvement in your driving record, such as avoiding further violations or accidents, can positively impact your insurance premiums. Consider defensive driving courses or other programs to enhance your driving skills and potentially earn discounts.

- Consider a Higher Deductible: Opting for a higher deductible can significantly reduce your monthly premiums. This strategy requires you to pay more out-of-pocket in the event of an accident but can save you money in the long run.

- Bundle Your Policies: Combining your auto insurance with other policies, such as homeowners or renters insurance, can often result in discounts. This strategy leverages the loyalty and bundling benefits offered by insurance companies.

- Maintain a Good Credit Score: Your credit score can surprisingly influence your auto insurance premiums. Maintaining a good credit score can lead to lower rates, especially with some insurance companies that use credit history as a risk factor.

Final Summary

Securing cheap auto insurance in Georgia doesn’t have to be a stressful endeavor. By understanding the key factors that influence premiums, utilizing online comparison tools, and actively negotiating with insurance providers, you can find affordable coverage that meets your needs. Remember, staying informed and proactive is key to finding the best deals and ensuring you’re protected on the road.