New Jersey drivers face a complex landscape when it comes to auto insurance. With a myriad of companies vying for your business, finding the right coverage at the best price can feel like an overwhelming task. This guide aims to demystify the process, offering a comprehensive overview of New Jersey’s auto insurance requirements, key factors influencing premiums, and strategies for securing the most advantageous coverage.

From understanding mandatory coverage to navigating the nuances of discounts and comparing quotes, we’ll equip you with the knowledge needed to make informed decisions about your auto insurance. We’ll also explore crucial aspects like choosing the right provider, maximizing savings, and staying safe on the road.

Understanding NJ Auto Insurance Requirements

Driving in New Jersey comes with certain responsibilities, including having the right auto insurance coverage. This ensures you are financially protected in case of an accident.

Mandatory Coverage Requirements

The state of New Jersey mandates specific auto insurance coverage to protect drivers and their passengers. These requirements are designed to ensure financial responsibility for damages and injuries resulting from accidents.

Minimum Liability Coverage Amounts

New Jersey law specifies the minimum liability coverage amounts required for all drivers. This coverage pays for damages and injuries caused to others in an accident.

- Bodily Injury Liability: This coverage protects you from financial responsibility for injuries caused to others in an accident. The minimum required coverage is $15,000 per person and $30,000 per accident.

- Property Damage Liability: This coverage pays for damage to another person’s vehicle or property in an accident. The minimum required coverage is $5,000 per accident.

Optional Coverage Options

While mandatory coverage is essential, drivers may consider additional coverage options to provide broader protection.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle in case of an accident, regardless of fault.

- Comprehensive Coverage: This coverage protects you from losses caused by events other than accidents, such as theft, vandalism, fire, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you in case you are involved in an accident with a driver who has no insurance or insufficient coverage.

Factors Affecting Auto Insurance Premiums in NJ

In New Jersey, as in other states, auto insurance premiums are determined by a variety of factors that assess your risk as a driver. Understanding these factors can help you make informed decisions that may lead to lower premiums.

Driving History

Your driving history is a major factor in determining your auto insurance rates. Insurance companies analyze your driving record to assess your risk. This includes:

- Accidents: Each accident, regardless of fault, increases your premium. The severity of the accident also plays a role, with more serious accidents resulting in higher premiums.

- Traffic Violations: Speeding tickets, reckless driving citations, and DUI convictions can significantly increase your premiums. Insurance companies view these as indicators of risky driving behavior.

- Points on your license: Each point on your license, accumulated through violations, adds to your risk profile and can lead to higher premiums.

Age

Age is a significant factor in determining auto insurance rates. Younger drivers, particularly those under 25, are generally considered higher risk due to their lack of experience and higher likelihood of accidents.

- Teen Drivers: Premiums for teenage drivers are typically higher than for older drivers, as they have less experience and are statistically more likely to be involved in accidents.

- Mature Drivers: Drivers over 65 often face higher premiums due to potential health issues that could affect their driving ability. However, some insurance companies offer discounts for senior drivers who complete defensive driving courses.

Vehicle Type

The type of vehicle you drive also plays a role in your auto insurance premiums.

- High-Performance Vehicles: Sports cars and other high-performance vehicles are more expensive to repair and often targeted by thieves, leading to higher premiums.

- Luxury Vehicles: Luxury vehicles, even if not high-performance, are generally more expensive to repair, which can result in higher premiums.

- Safety Features: Vehicles with advanced safety features like anti-lock brakes, airbags, and electronic stability control can qualify for discounts. Insurance companies recognize these features as reducing the likelihood and severity of accidents.

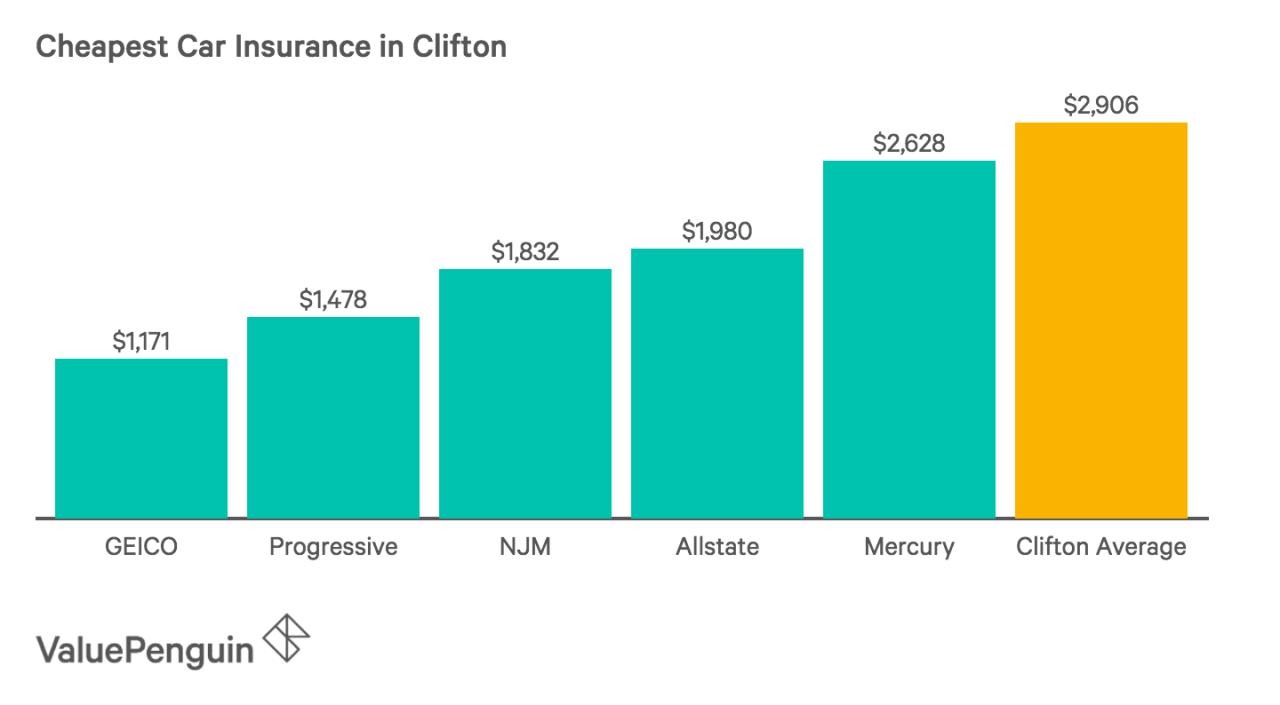

Location

The location where you live and drive can significantly impact your auto insurance rates.

- Urban Areas: Insurance premiums tend to be higher in urban areas due to higher traffic density, increased risk of theft, and more frequent accidents.

- Rural Areas: Premiums are often lower in rural areas due to less traffic and a lower likelihood of accidents.

Credit Score

In New Jersey, insurance companies can use your credit score as a factor in determining your auto insurance rates. This practice has been controversial, but it is allowed under state law.

- Credit Score and Risk: Insurance companies argue that a lower credit score is correlated with a higher risk of filing insurance claims. This correlation is based on the idea that individuals with poor credit may be more likely to engage in risky behavior, including driving recklessly.

- Impact on Premiums: Drivers with lower credit scores may face higher premiums than those with good credit, even if they have identical driving records.

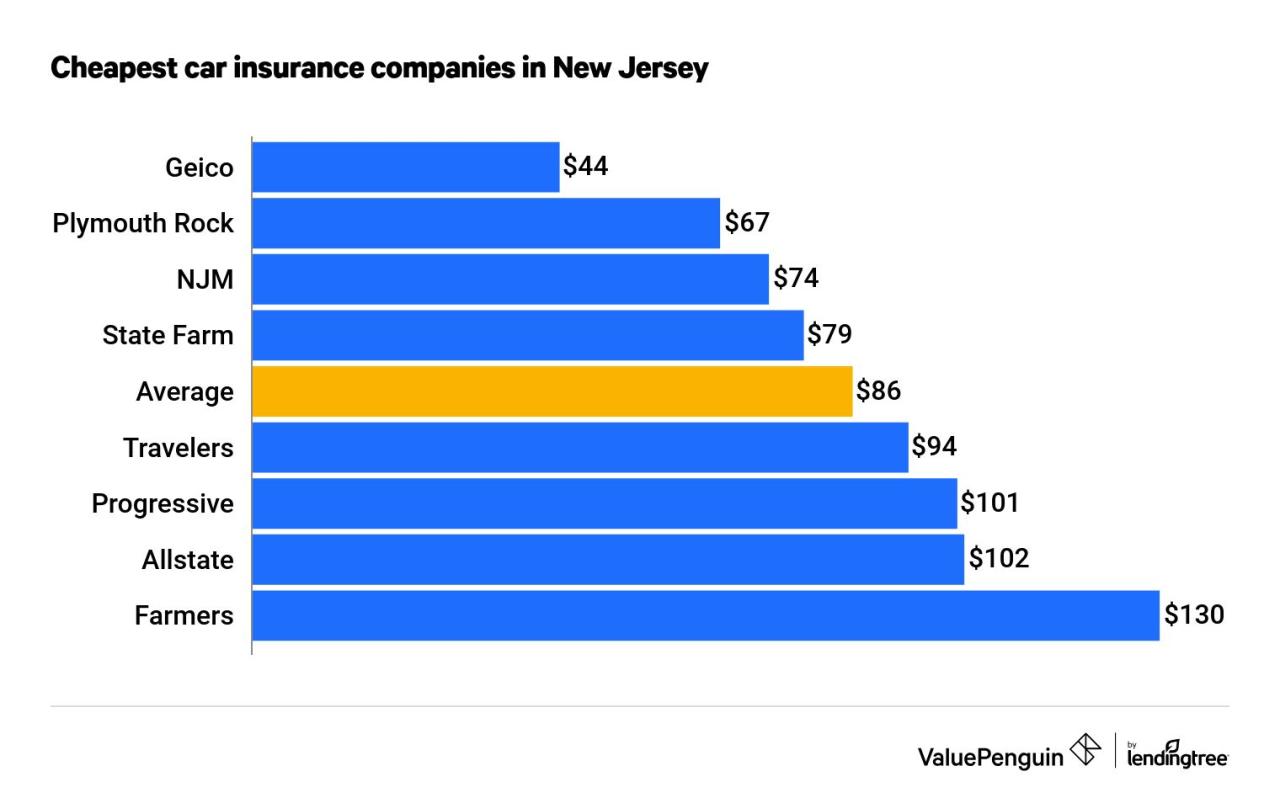

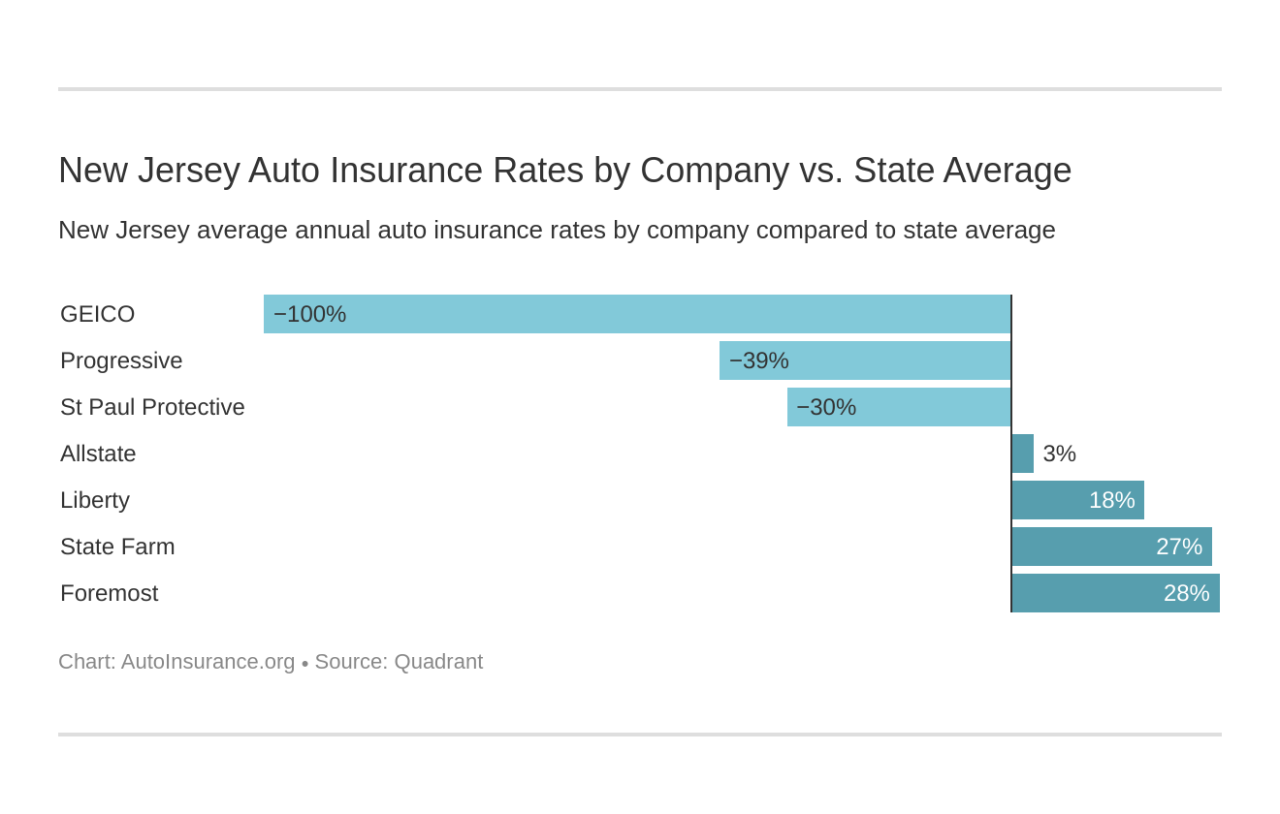

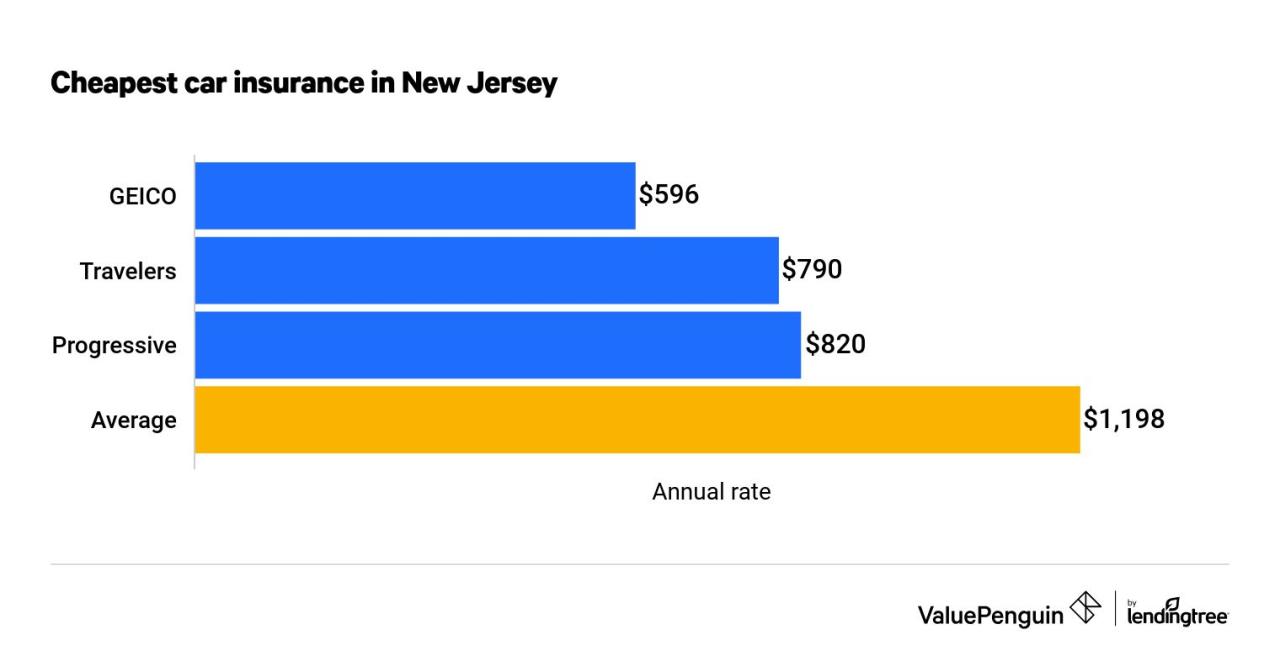

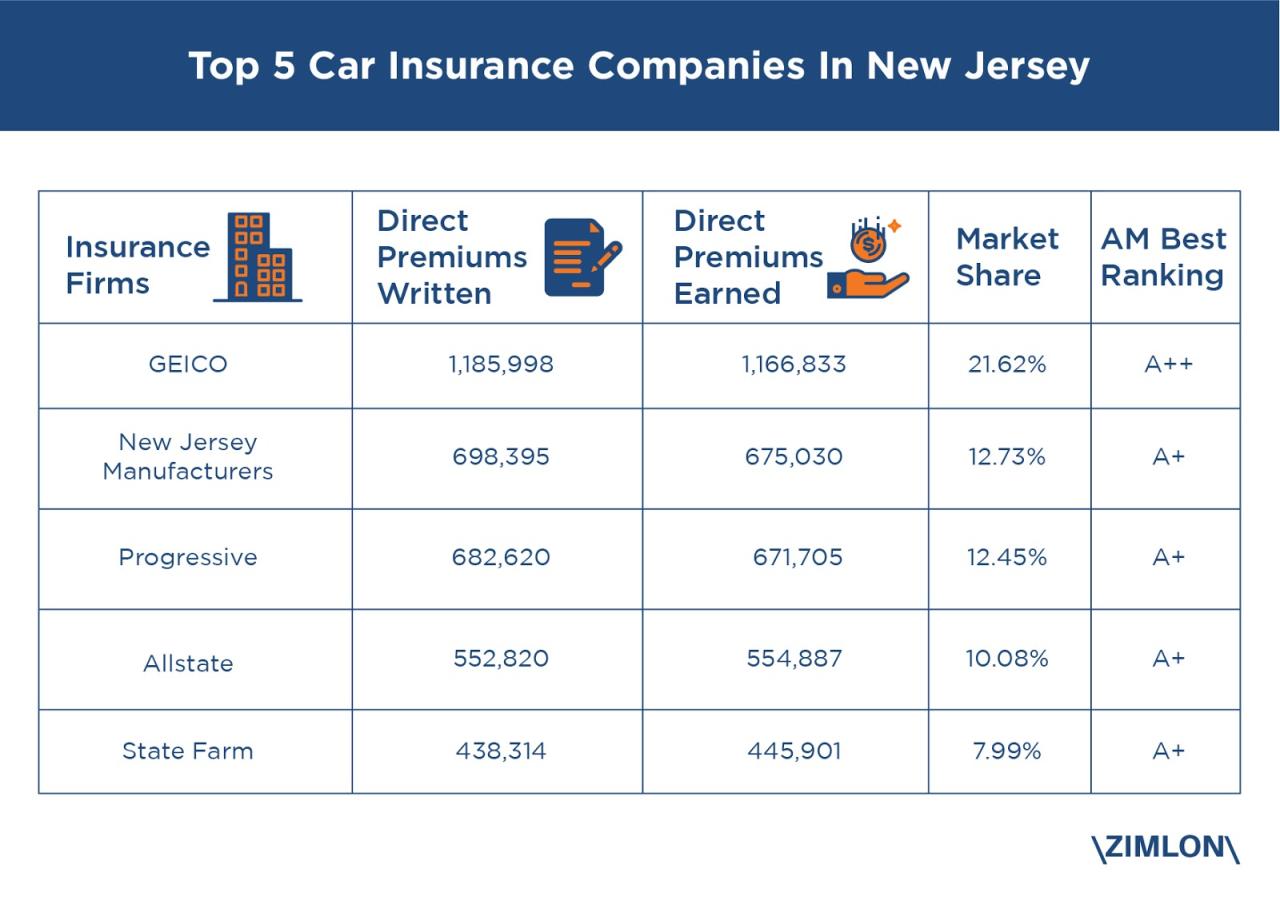

Top Auto Insurance Companies in New Jersey

Choosing the right auto insurance company in New Jersey is crucial for protecting your finances and ensuring you have adequate coverage. The state’s competitive market offers a wide range of options, making it essential to understand which companies consistently provide excellent service and value.

Top Auto Insurance Companies in New Jersey

This section examines the top 10 auto insurance companies in New Jersey based on market share and customer satisfaction ratings. These companies have earned a reputation for reliability, affordability, and customer-centric service.

| Rank | Company Name | Market Share (%) | Customer Satisfaction Rating |

|---|---|---|---|

| 1 | Geico | 15.5 | 87 |

| 2 | State Farm | 14.2 | 85 |

| 3 | Progressive | 13.8 | 84 |

| 4 | Allstate | 11.5 | 83 |

| 5 | Liberty Mutual | 8.2 | 82 |

| 6 | USAA | 7.1 | 89 |

| 7 | New Jersey Manufacturers Insurance Company (NJM) | 6.8 | 86 |

| 8 | Nationwide | 6.5 | 85 |

| 9 | Travelers | 5.4 | 84 |

| 10 | Erie Insurance | 4.8 | 87 |

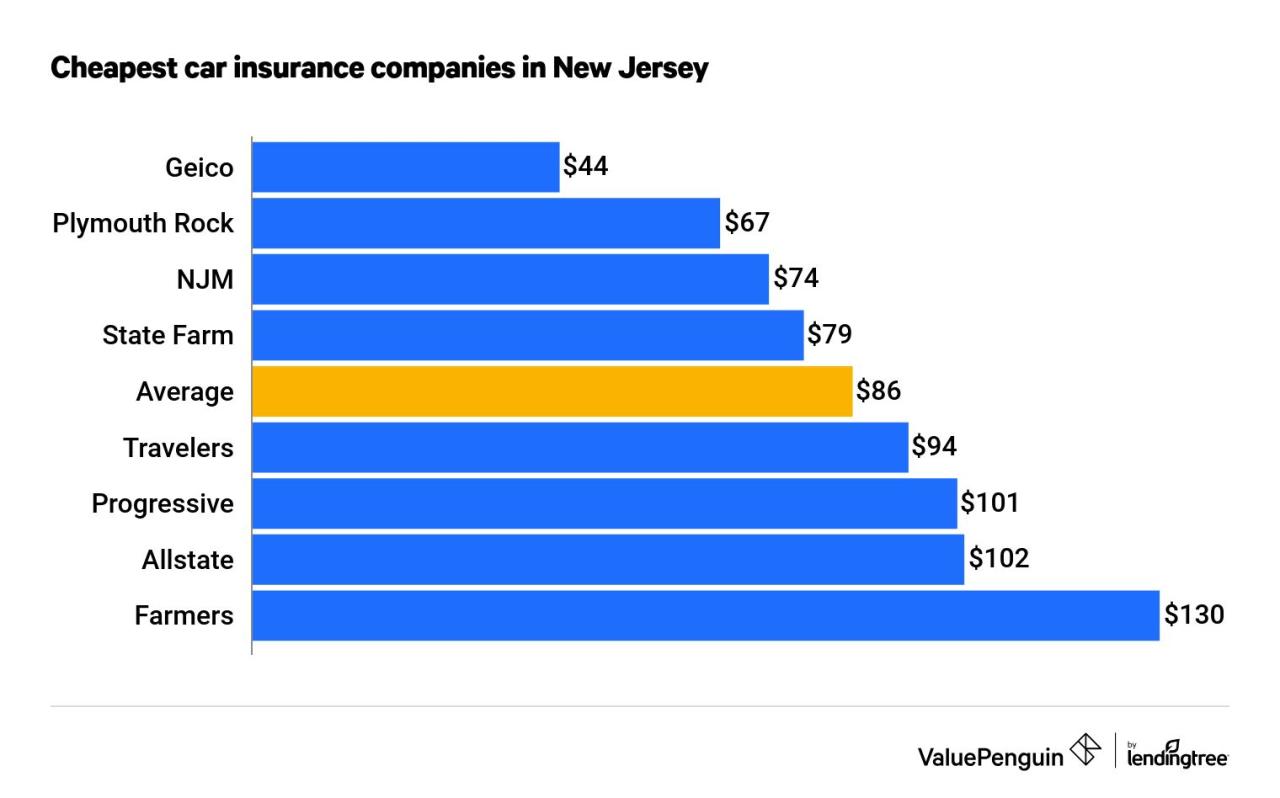

Comparing Auto Insurance Quotes

Finding the best auto insurance deal in New Jersey requires comparing quotes from multiple companies. This process helps you identify the most competitive rates and coverage options that fit your specific needs.

Coverage Options

The different types of coverage offered by insurance companies play a significant role in determining your premium. It’s crucial to understand these options and choose the ones that provide adequate protection for your situation.

- Liability Coverage: This coverage is mandatory in New Jersey and protects you financially if you cause an accident that results in injuries or property damage to others. It typically includes bodily injury liability and property damage liability.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in a collision, regardless of fault.

- Comprehensive Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged by events other than a collision, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who is uninsured or underinsured. It covers your medical expenses and property damage.

- Personal Injury Protection (PIP): This coverage, also known as “no-fault” insurance, covers your medical expenses, lost wages, and other related costs regardless of fault.

Deductibles

Deductibles are the amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible generally translates to a lower premium.

- Collision and Comprehensive Coverage: Deductibles for these coverages typically range from $250 to $1,000.

- Uninsured/Underinsured Motorist Coverage: Deductibles for this coverage are typically lower, often $100 or $250.

Discounts

Many insurance companies offer discounts to lower your premium. It’s important to inquire about these discounts and ensure you qualify for them.

- Good Driver Discount: This discount is offered to drivers with a clean driving record.

- Safe Driver Discount: This discount is offered to drivers who complete defensive driving courses.

- Multi-Car Discount: This discount is offered to policyholders who insure multiple vehicles with the same company.

- Multi-Policy Discount: This discount is offered to policyholders who bundle their auto insurance with other types of insurance, such as homeowners or renters insurance.

- Payment Discount: This discount is offered to policyholders who pay their premiums in full or choose automatic payments.

Tips for Obtaining Accurate and Competitive Quotes

- Get Quotes from Multiple Companies: Comparing quotes from at least three or four different companies is essential to find the best deal.

- Provide Accurate Information: When obtaining quotes, be sure to provide accurate information about your driving history, vehicle, and coverage needs. Inaccurate information can lead to inaccurate quotes.

- Ask About Discounts: Inquire about all available discounts, including good driver, safe driver, multi-car, multi-policy, and payment discounts.

- Consider Your Coverage Needs: Carefully consider the coverage options you need based on your individual circumstances and risk tolerance.

- Review Your Policy Regularly: It’s a good practice to review your auto insurance policy at least once a year to ensure that it still meets your needs and that you’re taking advantage of all available discounts.

Discounts and Savings

Lowering your auto insurance premiums in New Jersey can be achieved by taking advantage of various discounts offered by insurance companies. These discounts can significantly reduce your overall costs, making your car insurance more affordable.

Common Auto Insurance Discounts in New Jersey

- Safe Driver Discount: This is one of the most common discounts available. Insurance companies reward drivers with clean driving records by offering lower premiums. A clean record means no accidents or traffic violations for a certain period, typically three to five years. The discount percentage can vary based on the insurer and the driver’s specific driving history.

- Good Student Discount: This discount is designed to encourage academic excellence and responsible behavior. Students who maintain a certain GPA or rank in their class may qualify for this discount. The specific requirements vary by insurance company, but typically a B average or higher is required.

- Multi-Policy Discount: Bundling your auto insurance with other types of insurance, such as homeowners or renters insurance, can result in significant savings. This is because insurance companies often offer discounts for customers who have multiple policies with them.

- Anti-theft Device Discount: Installing anti-theft devices, such as alarm systems or GPS tracking devices, can deter theft and reduce the risk of claims for insurance companies. As a result, they may offer a discount to policyholders who have these devices installed in their vehicles.

- Defensive Driving Course Discount: Completing a certified defensive driving course can demonstrate your commitment to safe driving practices. Insurance companies often reward this commitment by offering a discount on your premiums. The course helps you learn about safe driving techniques and road safety rules.

- Loyalty Discount: Some insurance companies offer discounts to customers who have been with them for a certain period. This loyalty discount is a way for companies to reward long-term customers and encourage them to continue their business.

Maximizing Discounts and Savings

To maximize your discounts and save on auto insurance premiums, consider the following strategies:

- Maintain a Clean Driving Record: Avoid accidents and traffic violations to qualify for the safe driver discount. This involves practicing safe driving habits, following traffic rules, and being aware of your surroundings.

- Enroll in a Defensive Driving Course: Completing a certified defensive driving course can demonstrate your commitment to safe driving and potentially earn you a discount. The course can also enhance your driving skills and improve your overall safety on the road.

- Bundle Your Insurance Policies: Consider bundling your auto insurance with other types of insurance, such as homeowners or renters insurance, to take advantage of multi-policy discounts. This can lead to significant savings on your premiums.

- Compare Quotes from Multiple Insurers: Get quotes from several insurance companies to compare their rates and available discounts. Don’t hesitate to negotiate with your current insurer to see if they can match or beat a lower quote from a competitor.

- Shop Around for Discounts: Ask about all available discounts when you get quotes. Don’t assume you’re aware of all the options. Be proactive in exploring all possible discounts, including those specific to your occupation, military service, or other factors.

- Review Your Policy Regularly: Periodically review your auto insurance policy to ensure you’re still taking advantage of all available discounts. Changes in your driving record, vehicle, or living situation may make you eligible for additional discounts.

Understanding Insurance Policies

Navigating the complexities of an auto insurance policy can be daunting. Understanding the key terms and conditions is essential for making informed decisions and ensuring you’re adequately protected. This section will provide a comprehensive overview of the essential elements found in a typical New Jersey auto insurance policy.

Policy Definitions

Auto insurance policies are packed with technical terms. Knowing what these terms mean is crucial for understanding your coverage and rights. Here are some of the most important definitions:

- Policyholder: The individual or entity named in the policy who owns the insurance.

- Insured: Anyone covered by the policy, which may include the policyholder, family members, and others authorized to drive the insured vehicle.

- Covered Vehicle: The vehicle(s) specifically listed in the policy and covered by the insurance.

- Deductible: The amount you pay out-of-pocket before your insurance coverage kicks in.

- Premium: The amount you pay for your insurance coverage, typically paid in monthly installments.

- Coverage Limits: The maximum amount your insurance company will pay for a covered claim.

- Exclusions: Specific situations or events that are not covered by the policy.

- Endorsements: Additional coverage options that can be added to your policy, such as roadside assistance or rental car reimbursement.

Filing a Claim

When an accident occurs, knowing how to file a claim is crucial. Here’s a step-by-step guide:

- Report the accident: Contact your insurance company immediately, providing details of the accident, including date, time, location, and parties involved.

- Gather information: Collect contact information from all parties involved, including names, addresses, phone numbers, and insurance details.

- Document the scene: Take photos or videos of the damage to your vehicle and the accident scene, if safe to do so.

- Obtain a police report: If the accident involves injuries or significant damage, request a police report.

- File a claim: Complete your insurance company’s claim form, providing all relevant information and documentation.

Resolving Disputes

Disputes with your insurance company can arise regarding the coverage of a claim or the amount of compensation offered. Here’s how to navigate these situations:

- Review your policy: Carefully read your policy to understand your coverage and rights.

- Contact your insurance company: Explain your concerns and request a review of the claim.

- Seek independent advice: Consult with an attorney or a qualified insurance professional to understand your options.

- File a complaint: If your dispute remains unresolved, you can file a complaint with the New Jersey Department of Banking and Insurance.

Choosing the Right Insurance Provider

Selecting the right auto insurance company in New Jersey is crucial for ensuring adequate coverage and peace of mind. With numerous options available, careful consideration of several factors is essential to find the best fit for your needs and budget.

Factors to Consider

When choosing an auto insurance company in New Jersey, it’s important to consider several key factors. These factors will help you narrow down your options and select a provider that aligns with your specific requirements and preferences.

- Coverage Options: Different insurance companies offer various coverage options, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage. It’s crucial to compare the coverage levels and limits offered by different providers to ensure you have adequate protection.

- Premiums and Discounts: Auto insurance premiums vary significantly based on factors such as driving history, vehicle type, and location. Compare quotes from multiple companies to find the most competitive rates. Look for available discounts, such as safe driver, good student, and multi-policy discounts, to potentially lower your premium.

- Financial Stability: The financial stability of an insurance company is essential, as it ensures they can pay claims in the event of an accident. Check the company’s ratings from organizations like AM Best or Standard & Poor’s to gauge their financial strength.

- Customer Service: Excellent customer service is crucial for a positive insurance experience. Consider factors such as responsiveness, availability, and the ease of contacting the company for questions or assistance.

- Claims Handling Experience: A company’s claims handling experience is critical when you need to file a claim. Research their claims processing time, customer satisfaction ratings, and reputation for fairness and efficiency.

- Reputation and Reviews: Before choosing a company, read online reviews and customer testimonials to gain insights into their overall reputation and customer satisfaction levels.

Customer Service, Financial Stability, and Claims Handling

These factors play a significant role in your overall insurance experience and should be carefully considered.

- Customer Service: Responsive and helpful customer service is essential, especially when dealing with complex issues or filing a claim. Look for companies with readily available customer support channels, such as phone, email, and online chat.

- Financial Stability: A financially stable insurance company is more likely to be able to pay claims promptly and efficiently. Checking a company’s ratings from reputable financial organizations can provide valuable insights into their financial strength and ability to meet their obligations.

- Claims Handling Experience: A company’s claims handling process can significantly impact your experience after an accident. Research their reputation for fairness, efficiency, and responsiveness in handling claims. Look for companies with a track record of timely claim processing and positive customer feedback.

Tips for Safe Driving

Safe driving practices are essential in New Jersey, where traffic congestion and diverse road conditions can pose challenges. By adhering to these tips, drivers can reduce their risk of accidents, protect themselves and others, and potentially lower their auto insurance premiums.

Defensive Driving Techniques

Defensive driving involves anticipating potential hazards and taking proactive measures to avoid accidents.

- Maintain a Safe Following Distance: The “three-second rule” is a widely accepted guideline for following distance. This means you should be able to count three seconds between your vehicle and the vehicle in front of you. This allows ample time to react to sudden braking or other unexpected events.

- Be Aware of Your Surroundings: Constantly scan your surroundings, including your mirrors, blind spots, and the road ahead. Be aware of other vehicles, pedestrians, cyclists, and potential hazards.

- Avoid Distractions: Distracted driving is a leading cause of accidents. Avoid using your phone, eating, or engaging in other activities that take your attention away from the road.

- Be Prepared for Unexpected Situations: Always be ready to react quickly to sudden changes in traffic conditions. Know how to use your brakes and steering wheel effectively to avoid accidents.

Avoiding Distractions

Distracted driving is a major contributing factor to accidents in New Jersey. It’s crucial to eliminate distractions while behind the wheel.

- Mobile Phone Use: Using a mobile phone while driving, even hands-free, is a significant distraction. The best practice is to avoid using your phone completely while driving.

- Texting: Texting while driving is extremely dangerous and should be strictly avoided. It significantly impairs your reaction time and ability to focus on the road.

- Eating and Drinking: Eating or drinking while driving can take your attention away from the road and increase the risk of accidents.

- Passengers: While it’s important to be courteous to passengers, excessive conversations or distractions from passengers can also affect your driving focus.

Resources for Auto Insurance Information

Navigating the complexities of auto insurance in New Jersey can be daunting. Fortunately, a wealth of resources is available to provide you with the information you need to make informed decisions. From government agencies to consumer advocacy groups, these resources offer valuable insights into insurance requirements, coverage options, and cost-saving strategies.

Government Websites

Government websites are an essential starting point for understanding auto insurance regulations and requirements in New Jersey. The New Jersey Department of Banking and Insurance (DOBI) serves as the primary regulator for the state’s insurance industry. This website provides access to comprehensive information on:

- Insurance requirements: Details on mandatory coverages, such as liability, personal injury protection (PIP), and uninsured/underinsured motorist (UM/UIM) coverage.

- Consumer protection: Information on consumer rights, complaint procedures, and resources for resolving insurance disputes.

- Financial stability of insurers: Ratings and financial data on insurance companies operating in New Jersey, allowing you to assess their financial soundness.

The New Jersey Motor Vehicle Commission (MVC) also plays a crucial role in vehicle registration and licensing. Their website provides information on:

- Driver’s license requirements: Details on obtaining and maintaining a driver’s license, including requirements for different types of licenses.

- Vehicle registration: Information on registering your vehicle in New Jersey, including necessary documents and fees.

- Traffic violations: Information on traffic violations, penalties, and how they can impact your insurance premiums.

Insurance Coverage for Specific Situations

While standard auto insurance policies provide coverage for various common scenarios, specific situations require additional considerations. Understanding the nuances of coverage for incidents like driving under the influence, accidents involving uninsured drivers, and car theft is crucial for ensuring adequate protection.

Driving Under the Influence

Driving under the influence of alcohol or drugs significantly increases the risk of accidents and can have severe legal and financial consequences. Auto insurance policies typically offer limited coverage for such situations, often excluding coverage for damages or injuries caused by a driver found to be intoxicated.

Accidents Involving Uninsured Drivers

Uninsured motorist coverage is essential in New Jersey, as it protects you in the event of an accident caused by a driver who does not have adequate insurance. This coverage helps cover medical expenses, lost wages, and property damage up to the policy limits.

- Uninsured Motorist Coverage: This coverage protects you in the event of an accident caused by a driver who is uninsured or underinsured. It covers medical expenses, lost wages, and property damage up to the policy limits.

- Underinsured Motorist Coverage: This coverage applies when the other driver has insurance but their limits are insufficient to cover your losses. It bridges the gap between the other driver’s coverage and your own policy limits.

Car Theft

Comprehensive auto insurance coverage protects your vehicle against theft and other non-collision incidents. This coverage helps replace or repair your stolen vehicle, subject to policy limitations.

- Comprehensive Coverage: This coverage protects your vehicle against theft, vandalism, fire, hail, and other non-collision incidents. It helps cover the cost of repairs or replacement, minus the deductible.

- Deductible: This is the amount you pay out of pocket before your insurance coverage kicks in. A higher deductible typically leads to lower premiums.

New Jersey Auto Insurance Laws and Regulations

New Jersey has a comprehensive set of auto insurance laws and regulations designed to ensure financial protection for drivers and passengers involved in accidents. These laws are enforced by the New Jersey Department of Banking and Insurance (DOBI), which plays a crucial role in regulating the state’s auto insurance market.

Role of the New Jersey Department of Banking and Insurance

The DOBI is responsible for overseeing the auto insurance industry in New Jersey, ensuring that insurers operate fairly and responsibly. Its primary functions include:

- Licensing and regulating insurance companies

- Setting minimum insurance requirements for all drivers

- Approving insurance rates and policies

- Investigating consumer complaints and resolving disputes

- Promoting consumer education and awareness about auto insurance

Key Auto Insurance Laws and Regulations in New Jersey

- Minimum Insurance Requirements: All drivers in New Jersey are required to carry a minimum amount of liability insurance coverage, which protects others in case of an accident. The minimum coverage requirements include:

- Liability Coverage: $15,000 per person/$30,000 per accident for bodily injury, and $5,000 for property damage.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects drivers and passengers if they are injured in an accident caused by an uninsured or underinsured driver. The minimum requirement is $15,000 per person/$30,000 per accident.

- No-Fault System: New Jersey operates under a no-fault insurance system, where drivers are required to file claims with their own insurance company, regardless of who is at fault in an accident. This system aims to reduce litigation and expedite claims processing.

- Personal Injury Protection (PIP): All drivers in New Jersey must carry PIP coverage, which covers medical expenses, lost wages, and other related costs incurred by the insured and their passengers in an accident, regardless of fault.

- Mandatory Coverage: In addition to the minimum liability and PIP coverage, drivers may also be required to carry other coverage, such as collision and comprehensive coverage, depending on their financing arrangements or lease agreements.

- Rate Regulation: The DOBI regulates auto insurance rates in New Jersey, ensuring that they are fair and reasonable. Insurers must submit their rates to the DOBI for approval, and the DOBI reviews them to ensure they are justified based on factors such as risk, expenses, and profitability.

- Consumer Protection: New Jersey has strong consumer protection laws in place to safeguard drivers’ rights and ensure they are treated fairly by insurance companies. These laws include:

- Right to Choose: Drivers have the right to choose their own insurance company and coverage options.

- Right to Appeal: Drivers can appeal insurance company decisions, such as rate increases or claim denials, to the DOBI.

- Right to Fair Claims Handling: Drivers are entitled to fair and prompt claims handling from insurance companies.

Last Word

Armed with this knowledge, you can confidently approach the process of securing auto insurance in New Jersey. Remember, understanding your needs, comparing quotes, and leveraging available discounts are essential steps in finding the optimal coverage that protects you and your wallet. By taking a proactive approach, you can navigate the complexities of the insurance market and find the right policy for your unique situation.