The allure of ditching glasses or contacts and achieving clear vision through LASIK eye surgery is undeniable. But before diving into this life-altering procedure, a critical question arises: does insurance cover LASIK?

This comprehensive guide unravels the complexities of insurance coverage for LASIK, providing insights into the factors that influence your eligibility, understanding policy nuances, and exploring alternative financing options. Whether you’re considering LASIK or simply seeking clarity on its insurance implications, this guide will equip you with the knowledge to make informed decisions.

Does Insurance Cover LASIK Eye Surgery?

Navigating the world of healthcare coverage can be confusing, especially when it comes to elective procedures like LASIK eye surgery. This article aims to provide a comprehensive overview of whether insurance typically covers LASIK and the factors that influence coverage decisions.

LASIK, or Laser-Assisted In Situ Keratomileusis, is a refractive surgery that permanently corrects vision problems such as nearsightedness, farsightedness, and astigmatism. The procedure involves reshaping the cornea, the clear outer layer of the eye, using a laser to improve vision clarity and reduce or eliminate the need for glasses or contact lenses. LASIK offers numerous benefits, including improved visual acuity, increased independence from corrective lenses, and enhanced quality of life. However, the cost of LASIK can be a significant factor for many individuals, prompting the question of insurance coverage.

Cost of LASIK

The cost of LASIK can vary widely depending on several factors, including the surgeon’s experience, the location of the clinic, and the individual’s specific eye condition. On average, LASIK surgery can range from $1,500 to $6,000 per eye. This cost typically includes the initial consultation, pre-operative tests, the surgery itself, and post-operative care.

Insurance Coverage for LASIK

LASIK eye surgery is a popular procedure that can correct vision problems such as nearsightedness, farsightedness, and astigmatism. However, the cost of LASIK can be significant, and many people wonder if their insurance will cover it. Whether or not your insurance covers LASIK depends on several factors, including your insurance plan, your health status, and the specific details of your LASIK procedure.

Factors Influencing LASIK Coverage

Insurance coverage for LASIK is influenced by several factors, including:

- Type of insurance plan: Some insurance plans cover elective procedures like LASIK, while others do not. For instance, vision insurance plans may cover a portion of the cost of LASIK, but health insurance plans typically do not.

- Health status: Some insurance plans may not cover LASIK if you have pre-existing conditions that could affect the outcome of the surgery. For example, if you have diabetes or other health issues that affect your eyes, your insurance may not cover LASIK.

- Specific details of the LASIK procedure: The type of LASIK procedure you choose can also affect coverage. Some insurance plans may only cover certain types of LASIK, such as wavefront-guided LASIK.

- State regulations: Some states have laws that require insurance plans to cover LASIK, while others do not. It’s essential to check with your state’s insurance department to determine the specific regulations in your area.

Common Insurance Plans and LASIK Coverage

Here are some common insurance plans and their typical coverage for LASIK:

- Vision insurance: Vision insurance plans typically cover a portion of the cost of LASIK, but coverage varies widely depending on the plan. Some plans may offer a fixed dollar amount, while others may cover a percentage of the cost.

- Health insurance: Health insurance plans typically do not cover LASIK, as it is considered an elective procedure. However, some health insurance plans may offer coverage for LASIK if it is medically necessary, such as if you have a condition that affects your vision and prevents you from performing your daily activities.

- Flexible spending accounts (FSAs) and health savings accounts (HSAs): You may be able to use funds from your FSA or HSA to pay for LASIK, as these accounts allow you to set aside pre-tax dollars for qualified medical expenses. However, it’s important to check with your FSA or HSA administrator to ensure that LASIK is covered.

Different Types of Insurance Policies and LASIK Coverage

The type of insurance policy you have can also influence your LASIK coverage. Here are some examples:

- Individual health insurance: Individual health insurance plans typically do not cover LASIK. However, some plans may offer coverage for LASIK if it is medically necessary.

- Employer-sponsored health insurance: Employer-sponsored health insurance plans may cover LASIK, but coverage varies depending on the plan. Some plans may offer coverage for LASIK as a benefit, while others may require you to meet specific criteria, such as having a certain level of vision impairment.

- Medicare and Medicaid: Medicare and Medicaid typically do not cover LASIK. However, there may be some exceptions, such as if you have a condition that affects your vision and prevents you from performing your daily activities.

Pre-Existing Conditions and LASIK Coverage

Pre-existing conditions can affect your LASIK coverage. Some insurance plans may not cover LASIK if you have a pre-existing condition that could affect the outcome of the surgery. For example, if you have diabetes or other health issues that affect your eyes, your insurance may not cover LASIK. It’s important to talk to your doctor and your insurance company to determine if your pre-existing conditions will affect your LASIK coverage.

Factors Affecting Coverage

While LASIK surgery is generally considered elective, several factors can significantly influence whether insurance will cover it. These factors encompass individual health status, age, occupation, pre-existing eye conditions, and specific vision needs.

Individual Health Status

Insurance companies may evaluate your overall health when determining coverage for LASIK. If you have a pre-existing medical condition that could potentially complicate the surgery or affect your recovery, your coverage might be limited or denied. For instance, individuals with diabetes, autoimmune disorders, or certain cardiovascular conditions may be at higher risk for complications and might not be eligible for coverage.

Age and Occupation

Age and occupation can also play a role in coverage. Some insurance plans may have age restrictions for LASIK, typically requiring individuals to be above a certain age to qualify. Similarly, certain occupations that require specific vision standards, such as pilots or military personnel, might have different coverage policies.

Pre-existing Eye Conditions

Individuals with pre-existing eye conditions, such as keratoconus, glaucoma, or retinal diseases, may find it challenging to get LASIK coverage. These conditions could increase the risk of complications or hinder the effectiveness of the surgery. Insurance companies may consider these factors when evaluating coverage and might require additional assessments or consultations before approving the procedure.

Specific Vision Needs

The specific vision needs of the individual can also influence coverage. For example, insurance plans may cover LASIK for individuals with severe nearsightedness, farsightedness, or astigmatism. However, they might not cover it for individuals with mild refractive errors or those seeking LASIK for purely cosmetic reasons.

Understanding Insurance Policies

Navigating the world of insurance policies can be a daunting task, especially when it comes to understanding the intricacies of coverage for elective procedures like LASIK. A thorough understanding of your insurance policy’s terms and conditions is crucial to ensure you’re informed about potential coverage and out-of-pocket expenses.

Reviewing Policy Details

Before considering LASIK surgery, it’s imperative to carefully review your insurance policy details. This involves going beyond the basic summary and delving into the fine print to uncover specific provisions related to vision correction procedures.

- Policy Type: Identify whether your policy is a health insurance plan, vision insurance plan, or a combination of both. This will help determine which coverage applies to LASIK.

- Covered Procedures: Check for specific language outlining the procedures covered under your plan. Look for terms like “refractive surgery,” “LASIK,” or “vision correction.”

- Exclusions and Limitations: Pay close attention to any exclusions or limitations that may apply to LASIK. Some policies may exclude elective procedures or have specific criteria for coverage.

Understanding Deductibles, Copayments, and Coinsurance

Deductibles, copayments, and coinsurance are key components of insurance policies that affect your out-of-pocket expenses. It’s essential to grasp their meaning and implications.

- Deductible: This is the amount you must pay out-of-pocket before your insurance coverage kicks in. For LASIK, your deductible might apply to the entire procedure or a portion of it.

- Copayment: A fixed amount you pay for each covered service, such as a doctor’s visit or surgery. Copayments for LASIK may vary depending on your policy.

- Coinsurance: A percentage of the covered costs you pay after meeting your deductible. For instance, you might pay 20% of the covered LASIK costs after your deductible is met.

Identifying Coverage Limits

Insurance policies often have coverage limits for specific procedures, including LASIK. These limits define the maximum amount your insurance will cover for the surgery.

- Annual Limit: Some policies have an annual limit on the total amount you can claim for vision correction procedures. This limit might restrict the coverage for LASIK.

- Lifetime Limit: Certain policies might have a lifetime limit on coverage for LASIK, meaning the total amount covered over your lifetime is capped.

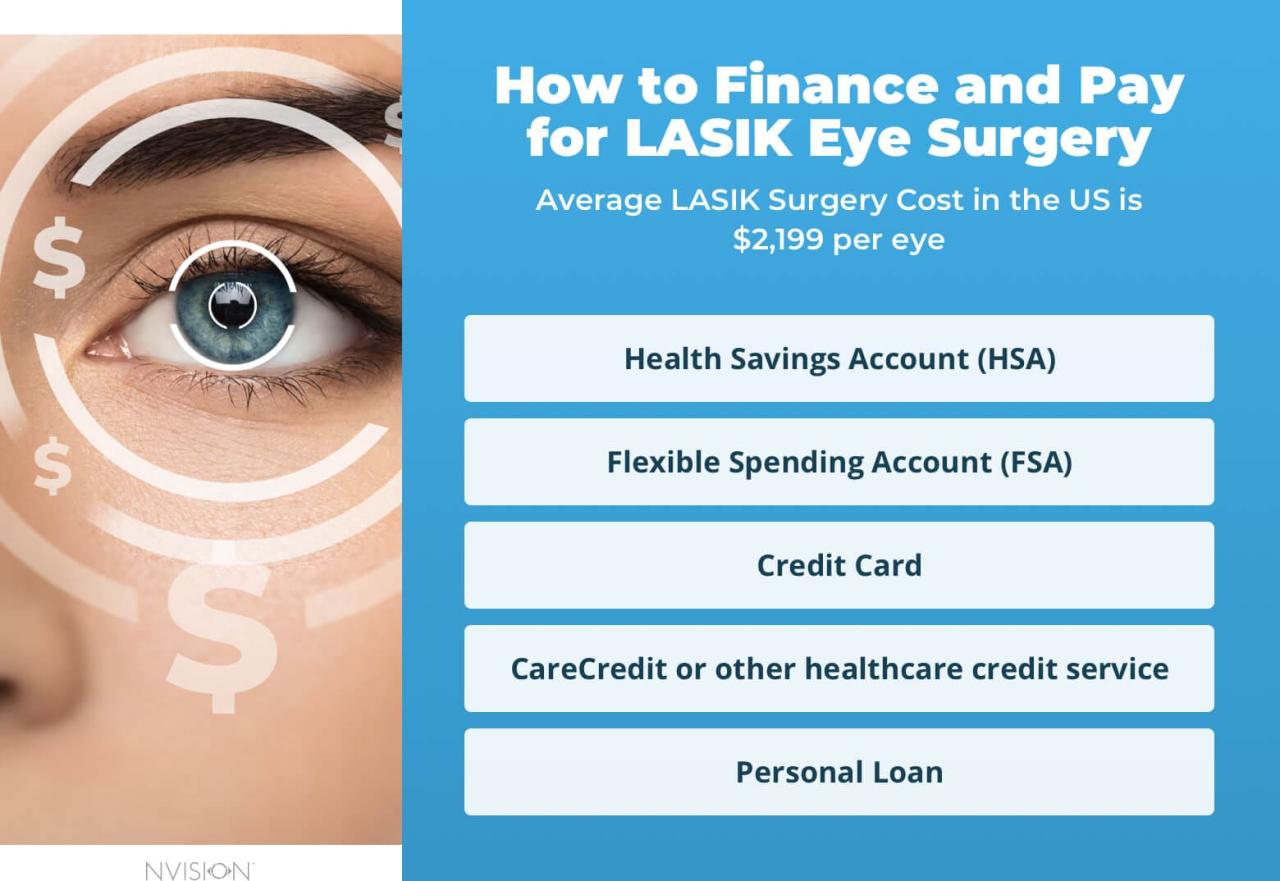

Alternatives to Insurance Coverage

While insurance can significantly reduce the cost of LASIK, many people find themselves without coverage or with limited coverage. This doesn’t mean LASIK is out of reach; several alternatives can help you finance your vision correction procedure.

Financing Options

Financing options can make LASIK more accessible, allowing you to spread the cost over time.

- Loans: LASIK providers often partner with financing companies to offer low-interest loans. These loans typically have flexible repayment terms, making it easier to manage the cost. For example, a patient could opt for a loan with a 5-year repayment term at a fixed interest rate of 5%, allowing them to pay off the loan gradually.

- Payment Plans: Many LASIK providers offer in-house payment plans, allowing you to pay for the procedure in installments over a set period. These plans usually have no interest charges, making them an attractive option. A patient could opt for a payment plan with a 12-month term, making monthly payments more manageable.

Discounts and Promotions

LASIK providers frequently offer discounts and promotions to attract new patients and incentivize bookings.

- Referral Programs: Many providers offer discounts to patients who refer new clients. These programs can save you a substantial amount on your procedure, especially if you have a large network of friends and family. A patient could receive a 10% discount on their LASIK procedure by referring a friend who also undergoes the surgery.

- Special Offers: LASIK providers often run limited-time promotions, offering discounts for specific procedures or during particular seasons. It’s always a good idea to check with providers for current promotions to maximize your savings. A patient could find a promotion offering a 20% discount on LASIK during a specific month, leading to significant cost savings.

Fundraising and Charitable Programs

For those facing financial challenges, fundraising and charitable programs can help make LASIK more attainable.

- Crowdfunding Platforms: Online platforms like GoFundMe allow you to raise funds from friends, family, and the wider community. You can create a campaign outlining your need for LASIK and your fundraising goal, allowing others to contribute to your vision correction journey.

- Charitable Organizations: Some organizations provide financial assistance for LASIK surgery to individuals with limited financial means. These programs often have specific eligibility criteria, such as income level or medical need. A patient could apply for a charitable program offering financial assistance for LASIK, potentially covering a portion of the cost.

Flexible Spending Accounts (FSAs) and Health Savings Accounts (HSAs)

FSAs and HSAs allow you to set aside pre-tax dollars to pay for eligible medical expenses, including LASIK.

- FSAs: Employees can contribute to FSAs through their employers, using pre-tax income to pay for healthcare expenses. The funds are typically available for use within a specific plan year. A patient could contribute to an FSA, using the pre-tax funds to pay for their LASIK surgery, potentially reducing their overall tax burden.

- HSAs: HSAs are available to individuals enrolled in high-deductible health plans. These accounts allow you to save pre-tax money to pay for healthcare expenses, including LASIK. HSA funds can be rolled over year after year, providing long-term savings for healthcare costs. A patient could contribute to an HSA and use the funds to pay for their LASIK surgery, potentially saving on taxes and building a healthcare savings account for future expenses.

Considerations Before LASIK

Before embarking on the journey of LASIK surgery, it is crucial to consult with an eye doctor and undergo a comprehensive eye exam. This thorough evaluation determines your suitability for the procedure and addresses any potential risks or complications.

Comprehensive Eye Exam

A comprehensive eye exam is a prerequisite for LASIK surgery. This evaluation assesses your overall eye health, refractive error, and corneal thickness. It includes:

- Visual Acuity Test: This test measures your ability to see at various distances.

- Refraction: This test determines your refractive error, which is the degree to which your eye focuses light.

- Corneal Topography: This test maps the shape of your cornea, which is the clear outer layer of your eye.

- Pupil Size Measurement: This test measures the size of your pupils in different lighting conditions.

- Eye Pressure Measurement: This test measures the pressure inside your eye, which can indicate glaucoma.

Questions to Ask Your Doctor

It is essential to have an open and honest conversation with your eye doctor to understand the potential benefits and risks of LASIK surgery. Here are some key questions to ask:

- What are the risks and potential complications of LASIK surgery?

- What is the success rate of LASIK surgery?

- What are the long-term effects of LASIK surgery?

- What are the alternative treatment options to LASIK surgery?

- How will my vision be affected after LASIK surgery?

- How long will it take to recover from LASIK surgery?

- What are the costs associated with LASIK surgery?

- Does my insurance cover LASIK surgery?

- What are the payment options available?

- How can I contact you if I have any questions or concerns after surgery?

Obtaining Multiple Quotes

To ensure you receive the best possible value for your LASIK surgery, it is recommended to obtain multiple quotes from different LASIK providers. This allows you to compare prices, technology, and experience levels.

Conclusion

The decision of whether or not to undergo LASIK surgery is a personal one, and understanding insurance coverage is a crucial part of that process. While LASIK is often considered an elective procedure, some insurance plans may offer partial or full coverage depending on specific circumstances.

Understanding Insurance Coverage

It is essential to carefully review your individual insurance policy to determine if LASIK is covered. Policies vary widely in their coverage for vision correction procedures. Factors such as pre-existing conditions, age, and medical necessity can influence coverage.

For example, some insurance plans may cover LASIK if it is deemed medically necessary due to a severe refractive error that hinders daily activities or work performance.

Last Word

While insurance coverage for LASIK can vary significantly, understanding the factors that influence it, navigating policy details, and exploring alternative financing options empowers you to make informed choices. Remember, consulting with your eye doctor and insurance provider is crucial for personalized guidance on your LASIK journey.