In the world of renting, navigating the complexities of insurance can be a daunting task. While most renters are familiar with renter’s insurance, a lesser-known but equally important option exists: rental home insurance. This specialized coverage goes beyond protecting your belongings, offering comprehensive protection for tenants who want to safeguard themselves from unexpected risks and liabilities.

Rental home insurance is a valuable tool for tenants who want to ensure their financial well-being and minimize potential losses. It provides coverage for a wide range of situations, from personal property damage to liability claims, offering a sense of security and peace of mind. This guide will delve into the intricacies of rental home insurance, exploring its key features, benefits, and how it can be tailored to meet individual needs.

What is Rental Home Insurance?

Rental home insurance is a specialized type of insurance designed to protect landlords and property owners from financial losses associated with their rental properties. It provides coverage for various risks, such as damage to the property, liability claims from tenants, and lost rental income.

Purpose of Rental Home Insurance

Rental home insurance serves as a financial safety net for landlords, mitigating the potential financial burden of unexpected events that can arise from owning and managing rental properties. This insurance helps protect landlords’ investments and ensures their continued financial stability even in the face of unforeseen circumstances.

Key Coverage Components of Rental Home Insurance

Rental home insurance policies typically include several key coverage components, offering comprehensive protection for landlords. These components are designed to address a wide range of potential risks, ensuring financial security for landlords.

Property Coverage

Rental home insurance policies provide coverage for damage to the rental property itself. This coverage typically extends to the structure of the building, including the roof, walls, plumbing, electrical systems, and other fixed components. It also includes coverage for personal property belonging to the landlord that is stored on the premises, such as appliances, furniture, and tools.

Liability Coverage

Landlords are often held liable for injuries or damages that occur on their property. Rental home insurance provides liability coverage to protect landlords from financial losses resulting from lawsuits or claims filed by tenants or other individuals. This coverage typically covers medical expenses, legal fees, and settlements arising from accidents, slip-and-falls, or other incidents that occur on the rental property.

Lost Rental Income Coverage

Rental home insurance policies often include coverage for lost rental income. This coverage helps landlords compensate for lost revenue if a covered event, such as a fire or natural disaster, renders the rental property uninhabitable. The policy may cover the rental income for a specific period, allowing landlords to maintain their financial stability during the time it takes to repair or rebuild the property.

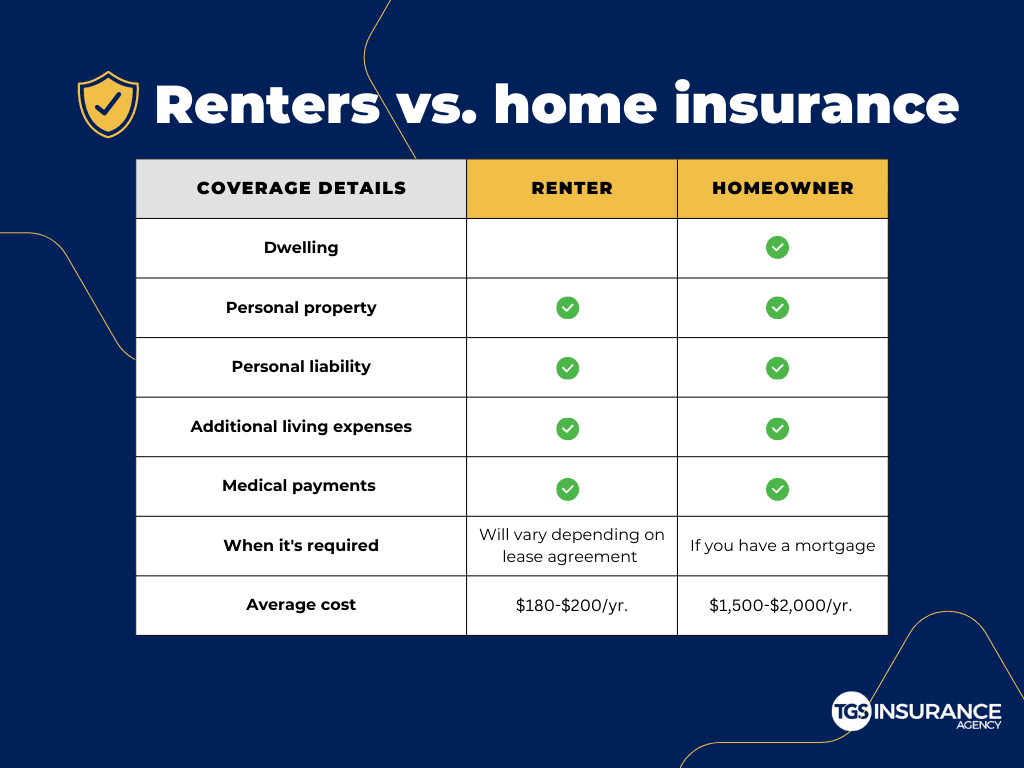

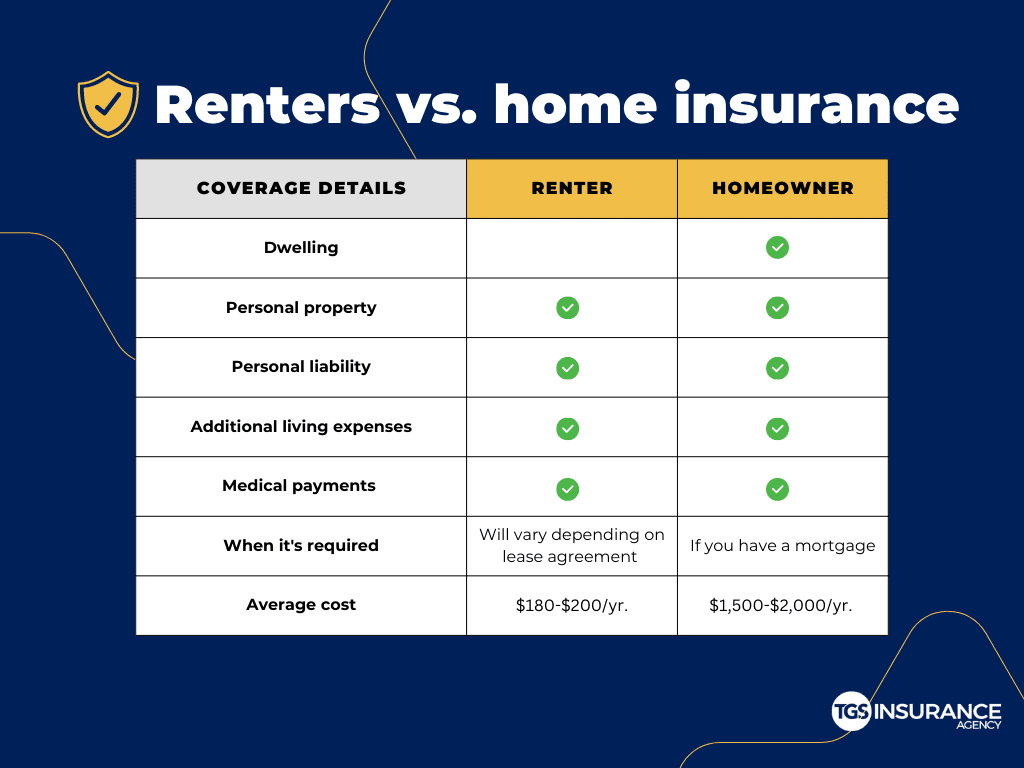

Comparison with Renter’s Insurance

While rental home insurance protects landlords, renter’s insurance is designed to protect tenants. It covers the tenant’s personal belongings, liability for damages caused to the rental property, and living expenses if the tenant is displaced due to a covered event.

Key Differences

- Coverage Focus: Rental home insurance focuses on protecting the landlord’s property and financial interests, while renter’s insurance protects the tenant’s belongings and liability.

- Insured Party: Rental home insurance covers the landlord, while renter’s insurance covers the tenant.

- Covered Risks: Rental home insurance covers risks related to the property itself, such as fire, vandalism, and natural disasters, while renter’s insurance covers risks related to the tenant’s belongings and liability.

- Cost: Rental home insurance premiums are typically higher than renter’s insurance premiums due to the broader coverage provided.

Who Needs Rental Home Insurance?

Rental home insurance is a valuable investment for tenants who want to protect their belongings and financial well-being. It offers coverage for unexpected events that could significantly impact your life, such as fire, theft, or natural disasters.

Benefits of Rental Home Insurance for Tenants

Rental home insurance provides crucial protection for tenants, especially in situations where they might face substantial financial losses. Here are some key benefits:

- Protection of Personal Belongings: Your personal property, including furniture, electronics, clothing, and other valuable items, is covered against damage or loss due to covered perils.

- Liability Coverage: This insurance provides financial protection if you are held liable for injuries or damages to others on your property, such as a guest tripping and falling.

- Additional Living Expenses: If your rental unit becomes uninhabitable due to a covered event, rental home insurance can help cover the costs of temporary housing, food, and other essential expenses until you can return to your home.

- Peace of Mind: Knowing that you have insurance coverage can provide peace of mind, allowing you to focus on recovering from a difficult situation without worrying about overwhelming financial burdens.

Risks and Liabilities for Tenants Without Rental Home Insurance

Tenants who choose not to purchase rental home insurance expose themselves to significant risks and liabilities. Without this coverage, they may face substantial financial losses in the event of unexpected events.

- Loss of Personal Property: If your belongings are damaged or stolen, you will be responsible for replacing them out of pocket, potentially incurring substantial costs.

- Liability Claims: If someone is injured on your property and you are found liable, you could face a lawsuit and be responsible for significant legal and medical expenses.

- Disruption to Your Life: In the event of a disaster, you may be forced to relocate temporarily, potentially facing significant expenses and inconvenience.

Scenarios Where Rental Home Insurance is Crucial

Rental home insurance is essential in several situations, where the financial consequences of unexpected events could be devastating:

- Fire: A fire in your rental unit could destroy your belongings and leave you without a place to live. Rental home insurance would cover the cost of replacing your belongings and provide temporary housing while your home is repaired or rebuilt.

- Theft: Theft can happen anywhere, and if your belongings are stolen from your rental unit, rental home insurance can help you replace them.

- Natural Disasters: Natural disasters such as hurricanes, floods, or earthquakes can cause significant damage to your rental unit and belongings. Rental home insurance can provide financial assistance to help you recover.

- Liability Claims: If someone is injured on your property and you are found liable, rental home insurance can help cover the cost of legal defense, medical expenses, and other related costs.

Coverage Options and Benefits

Rental home insurance offers a variety of coverage options designed to protect your belongings and financial well-being in the event of unforeseen circumstances. Understanding these options is crucial to ensure you have the right protection for your specific needs.

Personal Property Coverage

Personal property coverage protects your belongings from damage or loss due to covered perils, such as fire, theft, or vandalism. This coverage typically extends to your furniture, electronics, clothing, and other personal items. The amount of coverage you choose will determine the maximum amount your insurer will pay for covered losses.

For example, if you have $50,000 in personal property coverage and your belongings are damaged in a fire, your insurer will pay up to $50,000 for the replacement value of your lost or damaged items.

Liability Coverage

Liability coverage protects you from financial losses arising from accidents or injuries that occur on your property, causing harm to others. This coverage typically covers legal defense costs, medical expenses, and other related expenses.

For instance, if a visitor trips and falls on your property, causing them a serious injury, your liability coverage will help pay for their medical bills and legal fees if they sue you.

Additional Living Expenses

Additional living expenses coverage helps pay for temporary housing and other essential expenses if your rental property becomes uninhabitable due to a covered event. This coverage can help cover costs such as hotel stays, meals, and transportation.

Imagine your rental property is damaged by a fire, making it unsafe to live in. Additional living expenses coverage will help you pay for temporary housing while your property is being repaired or rebuilt.

Factors Influencing Premium Costs

Rental home insurance premiums are influenced by a variety of factors, ensuring that the cost reflects the risk associated with insuring a particular property and tenant. Understanding these factors can help tenants make informed decisions about their coverage and potentially reduce their premiums.

Location

The location of the rental property significantly impacts insurance premiums. Factors such as crime rates, natural disaster risks, and the cost of living in the area contribute to the overall risk profile of the property. For example, properties located in areas with high crime rates or frequent natural disasters like hurricanes or earthquakes will generally have higher premiums.

Property Value

The value of the rental property is directly proportional to the insurance premium. Higher-valued properties require greater coverage, leading to increased premiums. This is because the insurer needs to be able to adequately cover the cost of repairs or replacement in case of damage or loss.

Coverage Limits

The amount of coverage chosen by the tenant directly impacts the premium cost. Higher coverage limits mean greater protection for the tenant’s belongings and higher premiums. Tenants should carefully consider their individual needs and budget when selecting coverage limits.

Individual Risk Factors

Several individual risk factors can influence insurance premiums. These include the tenant’s credit history, claims history, and the presence of any hazardous activities on the property. For instance, tenants with poor credit scores or a history of filing claims may face higher premiums. Additionally, engaging in activities like owning a dog or having a home-based business can also increase premiums due to the associated risks.

Tips to Reduce Premiums

- Increase Your Deductible: A higher deductible means you pay more out of pocket in case of a claim, but it can significantly lower your premium.

- Improve Home Security: Installing security systems, such as alarms and motion sensors, can reduce the risk of theft and burglary, potentially leading to lower premiums.

- Maintain Your Property: Keeping the rental property well-maintained and addressing any potential hazards can demonstrate responsible tenancy and reduce the risk of claims.

- Bundle Your Policies: Combining your renter’s insurance with other policies, such as car insurance, can often result in discounts.

- Shop Around: Compare quotes from multiple insurance companies to find the best rates and coverage options.

Claim Process and Procedures

Filing a claim under rental home insurance is a straightforward process, but it’s crucial to understand the steps involved and the necessary documentation. This ensures a smooth and efficient claim resolution.

Claim Filing

The first step is to report the claim to your insurance company as soon as possible after the incident. Most insurance companies have dedicated phone lines, online portals, or mobile apps for reporting claims.

- Immediately after the incident, take photos or videos of the damaged property. This visual documentation is crucial for supporting your claim.

- Keep detailed records of any expenses incurred due to the damage, including receipts for repairs or temporary accommodation.

- Provide accurate and complete information about the incident, including the date, time, location, and circumstances.

Claim Documentation

To support your claim, you will need to provide specific documentation. This includes:

- Proof of ownership or lease agreement: This document confirms your legal right to occupy the rental property.

- Police report (if applicable): If the damage was caused by a crime, a police report is essential.

- Detailed inventory list: This list should include all items covered by the insurance policy and their estimated value.

- Receipts and estimates for repairs: These documents are crucial for calculating the cost of the damage.

- Photographs or videos of the damaged property.

Claim Processing

Once you have filed a claim and provided the necessary documentation, the insurance company will initiate the claim processing. This typically involves:

- Reviewing your claim: The insurance company will review your claim details and the supporting documentation.

- Investigating the incident: The insurance company may conduct an investigation to determine the cause of the damage and the extent of the loss.

- Assessing the damage: An insurance adjuster will assess the damage and determine the cost of repairs or replacement.

- Negotiating a settlement: Once the damage has been assessed, the insurance company will negotiate a settlement with you.

- Paying the claim: The insurance company will pay the claim amount directly to you or to the repair or replacement service provider.

Claim Denial

While most claims are approved, there are instances where claims might be denied. This can happen due to various reasons, including:

- Failure to meet policy requirements: If the damage is not covered under your policy, the claim will be denied.

- Fraudulent claims: If the insurance company suspects that the claim is fraudulent, it will be denied.

- Pre-existing damage: If the damage is a result of pre-existing conditions, the claim might be denied.

Claim Appeals

If your claim is denied, you have the right to appeal the decision. This typically involves providing additional information or evidence to support your claim. The insurance company will review the appeal and make a final decision.

Finding the Right Policy

Finding the right rental home insurance policy involves a careful and strategic process to ensure you have adequate coverage at a reasonable price. The key is to compare quotes from multiple insurers and carefully evaluate the coverage options to determine the best fit for your individual needs and budget.

Comparing Quotes

Comparing quotes from multiple insurers is essential to ensure you get the best possible price for the coverage you need. It’s recommended to obtain quotes from at least three different insurers. You can use online comparison websites, contact insurers directly, or work with an insurance broker.

- When comparing quotes, make sure you are comparing apples to apples. This means comparing policies with the same coverage limits and deductibles.

- Pay attention to the fine print. Some insurers may have exclusions or limitations that are not immediately apparent.

- Consider the insurer’s financial stability and customer service reputation. You want to make sure you are dealing with a reputable company that will be there for you if you need to file a claim.

Evaluating Coverage Options

Once you have received several quotes, it’s important to carefully evaluate the coverage options offered by each insurer. Consider the following factors:

- Coverage Limits: Determine the amount of coverage you need for each type of loss, such as personal property, liability, and additional living expenses.

- Deductibles: A higher deductible will generally result in a lower premium, but you will have to pay more out of pocket if you need to file a claim. Consider your risk tolerance and budget when choosing a deductible.

- Exclusions and Limitations: Carefully review the policy’s exclusions and limitations. Some policies may not cover certain types of losses, such as damage caused by earthquakes or floods.

- Discounts: Many insurers offer discounts for various factors, such as having a good credit score, installing security systems, or bundling insurance policies. Inquire about any available discounts.

Choosing the Right Policy

Once you have carefully compared quotes and evaluated coverage options, you can choose the policy that best meets your needs and budget.

- Prioritize coverage: Focus on the coverage you need most, such as personal property, liability, and additional living expenses.

- Consider your budget: Choose a policy that you can afford without putting a strain on your finances.

- Read the policy carefully: Make sure you understand the terms and conditions of the policy before you sign it.

Understanding Exclusions and Limitations

Rental home insurance, like any insurance policy, has limitations and exclusions. It’s crucial to understand these aspects to avoid surprises during a claim. While the policy covers a wide range of potential perils, it’s not a blanket guarantee for every eventuality.

Common Exclusions and Limitations

Exclusions and limitations in rental home insurance policies are designed to mitigate risk and ensure fair pricing. Here are some common examples:

- Acts of War or Terrorism: Most policies exclude coverage for damage or loss caused by acts of war or terrorism. These events are considered high-risk and unpredictable, making them difficult to insure.

- Natural Disasters: Policies often have specific limitations for natural disasters like earthquakes, floods, or landslides. Some policies may require additional coverage for these perils, while others may have specific deductibles or coverage limits.

- Neglect or Intentional Damage: Coverage usually excludes damage caused by negligence or intentional acts of the insured or their tenants. This includes situations like leaving a window open during a storm or intentionally damaging the property.

- Wear and Tear: Normal wear and tear on the property is generally not covered by rental home insurance. This includes gradual deterioration of appliances, fixtures, or the building itself.

- Certain Personal Property: While rental home insurance covers personal property belonging to the insured, there are often limitations on the types of items covered. For instance, policies may exclude coverage for high-value items like jewelry, artwork, or collectibles unless they are specifically listed and insured separately.

Circumstances Where Coverage May Not Apply

Coverage may not apply in specific circumstances, even if the event itself is covered. For example:

- Failure to Meet Policy Requirements: If the insured fails to meet specific requirements of the policy, such as timely reporting of a claim or maintaining the property in a reasonable condition, coverage may be denied or reduced.

- Violation of Law: Coverage may not apply if the damage or loss is caused by an illegal activity conducted on the property. For example, if the tenant is involved in drug trafficking, and the property is damaged during a raid, the insurance may not cover the damages.

- Pre-existing Conditions: If the damage or loss is caused by a pre-existing condition that was not disclosed to the insurer during the application process, coverage may be limited or denied. This could include situations like a leaky roof that was known to the landlord but not mentioned during the application.

- Lack of Proper Maintenance: If the insured fails to maintain the property in a reasonable condition, and this neglect contributes to the damage or loss, coverage may be reduced or denied. For example, if a roof leak causes water damage because the roof wasn’t properly maintained, the insurance company might argue that the insured contributed to the damage.

Reviewing Policy Terms and Conditions

Thorough review of the policy terms and conditions is crucial. It’s essential to understand the specific exclusions and limitations that apply to your policy.

“Read your policy carefully, and don’t hesitate to ask questions if you’re unsure about anything.”

Understanding these aspects ensures you’re aware of potential limitations and can take appropriate steps to protect yourself and your investment.

Rental Home Insurance vs. Landlord Insurance

Rental home insurance and landlord insurance are two distinct types of coverage designed to protect different parties involved in a rental property. Understanding the key differences between these policies is crucial for both tenants and landlords to ensure they have the right protection in place.

Coverage Differences

Rental home insurance and landlord insurance offer distinct coverage, catering to the specific needs of tenants and landlords. Rental home insurance, also known as renter’s insurance, primarily protects tenants’ personal belongings from covered perils, while landlord insurance safeguards the property itself and protects the landlord’s financial interests.

- Rental Home Insurance: This policy covers the tenant’s personal belongings, including furniture, electronics, clothing, and other valuables, against risks like fire, theft, and natural disasters. It may also provide liability coverage, protecting the tenant from claims made by others for injuries or damages occurring on the rented premises.

- Landlord Insurance: This policy protects the landlord’s financial interests in the property, covering damages to the building structure, fixtures, and appliances. It also provides liability coverage for incidents that may occur on the property, such as tenant injuries or property damage caused by the tenant.

Responsibilities

The responsibilities of tenants and landlords differ significantly, as reflected in their respective insurance policies.

- Tenants: Tenants are responsible for insuring their personal belongings and are typically required to maintain a certain level of renter’s insurance as part of the lease agreement. They are also responsible for reporting any damage to the landlord promptly and taking reasonable steps to prevent further damage.

- Landlords: Landlords are responsible for insuring the property structure, including the building, fixtures, and appliances. They are also responsible for maintaining the property in a safe and habitable condition, addressing any necessary repairs promptly.

Importance of Understanding Coverage

Understanding the coverage provided by both rental home insurance and landlord insurance is crucial for both parties to avoid financial hardship in the event of a covered incident.

- Tenants: A tenant’s personal belongings may not be covered by the landlord’s insurance, so renter’s insurance is essential to protect their financial interests. This policy provides peace of mind knowing that their belongings are insured against various risks.

- Landlords: Landlord insurance is essential for protecting the landlord’s investment in the property and ensuring they are financially protected against various risks, including tenant negligence, vandalism, and natural disasters. It also provides liability coverage, safeguarding the landlord from lawsuits arising from accidents or injuries occurring on the property.

Legal Considerations

Rental home insurance, while primarily a financial safeguard for tenants, is also intertwined with legal considerations. Understanding the legal aspects of this insurance can help you navigate your rights and responsibilities as a renter.

State Regulations

State regulations play a significant role in defining the legal framework for rental home insurance. Each state has its own set of laws governing landlord-tenant relationships, including provisions related to insurance coverage. It’s crucial to be aware of the specific regulations in your state, as they can impact your insurance options and obligations.

- Some states might require landlords to provide certain types of insurance, such as liability coverage, while others may mandate tenants to have their own insurance for personal belongings.

- State laws might also specify the minimum coverage requirements for rental home insurance policies, such as the minimum amount of liability coverage or the types of perils covered.

- Understanding state regulations ensures that you’re compliant with the legal requirements and that your insurance policy aligns with the applicable laws.

Landlord-Tenant Agreements

Landlord-tenant agreements, also known as leases, are legally binding contracts that Artikel the terms of your tenancy. These agreements often include clauses related to insurance coverage, specifying the responsibilities of both landlords and tenants.

- Leases may require tenants to maintain their own rental home insurance, specifying the minimum coverage amounts or the types of perils covered.

- Landlord-tenant agreements can also specify the responsibility for damage to the rental property, including whether the tenant or landlord is responsible for repairs or replacement.

- It’s essential to carefully review the insurance provisions in your lease to understand your specific obligations and rights regarding rental home insurance.

Tenant Rights and Obligations

Rental home insurance policies provide tenants with specific rights and obligations. Understanding these aspects is essential for navigating insurance claims and ensuring your rights are protected.

- Tenants have the right to file claims under their rental home insurance policies for covered losses, such as damage to personal belongings or liability claims arising from accidents in the rental property.

- However, tenants are also obligated to comply with the terms and conditions of their insurance policies, including providing accurate information during the claims process and cooperating with the insurer’s investigations.

- It’s crucial to familiarize yourself with your policy’s provisions, including the coverage limits, deductibles, and any exclusions, to understand your rights and obligations in case of a claim.

Understanding the Legal Framework

Navigating the legal aspects of rental home insurance can be complex, but understanding the key legal principles can help you make informed decisions and protect your interests.

- Consulting with an insurance agent or a legal professional can provide you with personalized guidance and ensure that your insurance policy meets your specific needs and complies with all applicable laws.

- It’s essential to read and understand your insurance policy thoroughly, including the coverage details, exclusions, and any limitations, to avoid any surprises during a claim.

- Staying informed about the latest legal developments and regulations related to rental home insurance can help you make informed decisions and protect your rights as a renter.

Common Misconceptions

Rental home insurance is often misunderstood, leading to incorrect assumptions about its coverage and necessity. This can result in inadequate protection, leaving renters vulnerable to significant financial losses. It’s crucial to dispel these misconceptions to make informed decisions about your insurance needs.

Rental Home Insurance is Only for High-Value Possessions

It’s a common misconception that rental home insurance is only necessary for those with expensive belongings. While the coverage amount can be tailored to your needs, the policy provides more than just protection for your possessions. It also covers liability for accidents that occur on your property, as well as additional living expenses if you’re unable to live in your rental due to a covered event.

Rental home insurance can be a valuable asset for renters, regardless of the value of their belongings.

Landlord’s Insurance Covers My Belongings

Many renters believe their landlord’s insurance covers their personal property. However, landlord insurance primarily protects the building itself and the landlord’s financial interests. It does not cover your belongings or liability for accidents.

Your landlord’s insurance policy is not a substitute for rental home insurance.

I Can Rely on My Homeowner’s Policy

If you own a home, you may assume your homeowner’s policy covers your belongings in a rental property. However, this is not always the case. Some homeowner’s policies may offer limited coverage for personal property in a rental, while others may not cover it at all.

It’s essential to review your homeowner’s policy carefully to understand its coverage for rental properties.

Rental Home Insurance is Too Expensive

The cost of rental home insurance can vary depending on several factors, but it’s often more affordable than you might think. The premium is typically a small fraction of the value of your belongings and the potential financial consequences of an uninsured event.

Rental home insurance can provide peace of mind and financial security at a relatively low cost.

I Don’t Need Coverage If I Have Renter’s Insurance

Renter’s insurance is a common term for rental home insurance. However, some renters mistakenly believe that they don’t need coverage because they have a renter’s policy.

Rental home insurance and renter’s insurance are the same thing. It’s important to have this type of coverage, regardless of what you call it.

Importance of Comprehensive Protection

Renting a home can be a rewarding experience, but it’s crucial to remember that unexpected events can occur. From unforeseen accidents to natural disasters, the potential for financial and emotional hardship exists. Having comprehensive rental home insurance can provide a crucial safety net, mitigating the risks and safeguarding your well-being.

While some may consider insurance an unnecessary expense, the reality is that it offers invaluable protection in times of need. It can help you recover from a devastating fire, cover the cost of stolen belongings, or even provide temporary housing while repairs are underway.

Financial and Emotional Impact of Inadequate Insurance

The absence of adequate insurance can have significant financial and emotional consequences for renters. In the event of a covered loss, such as a fire or theft, you could be left facing substantial financial burdens.

- Replacing Lost Belongings: Without insurance, you would be responsible for replacing all your belongings, from furniture and electronics to clothing and personal items. This can be an overwhelming financial strain, especially if you don’t have savings to draw upon.

- Repair or Replacement Costs: If your apartment is damaged, you may be responsible for repair or replacement costs. This can be particularly expensive if the damage is extensive, and it could force you to move temporarily, adding to your expenses.

- Liability Claims: If someone is injured in your apartment, you could be held liable for their medical expenses and other damages. Without insurance, you could be facing a substantial financial judgment.

- Emotional Distress: The stress and anxiety of dealing with a major loss, such as a fire or theft, can be overwhelming. This can be exacerbated if you’re also facing financial hardship.

Prioritizing Safety and Security

Rental home insurance offers peace of mind, knowing that you’re protected from unforeseen events. It can help you focus on your well-being and recovery, rather than worrying about financial ruin.

- Protecting Your Financial Future: By obtaining adequate insurance, you’re safeguarding your financial future. You can rest assured that you’ll have the resources to recover from a major loss, without depleting your savings or taking on crippling debt.

- Minimizing Emotional Distress: Knowing that you have insurance can provide a sense of security and peace of mind. It can help you cope with the emotional stress of a difficult situation, allowing you to focus on rebuilding your life.

- Ensuring Continuity of Life: In the event of a covered loss, insurance can help you maintain continuity in your life. You can continue to live in your apartment, or find suitable temporary housing, while repairs are underway. You can also replace your belongings, allowing you to resume your normal life as quickly as possible.

Outcome Summary

Rental home insurance empowers tenants with a crucial safety net, providing financial protection against unforeseen events. By understanding the coverage options, benefits, and legal considerations associated with this type of insurance, tenants can make informed decisions to safeguard their assets and minimize financial risks. As you navigate the world of renting, remember that rental home insurance can be a valuable ally in ensuring your peace of mind and financial security.